Growing Demand for Genomic Research

The US Microarray Market is significantly influenced by the growing demand for genomic research across various sectors, including academia, pharmaceuticals, and biotechnology. As research institutions and companies increasingly focus on understanding genetic diseases and developing targeted therapies, the need for advanced microarray technologies becomes paramount. The National Institutes of Health (NIH) and other funding bodies are allocating substantial resources to genomic studies, which is likely to bolster the market. This trend suggests that the microarray market could see an influx of investment and innovation, as researchers seek to leverage these technologies for groundbreaking discoveries.

Rising Awareness of Genetic Disorders

The US Microarray Market is benefiting from a rising awareness of genetic disorders among the general population and healthcare professionals. As more individuals seek genetic testing for hereditary conditions, the demand for microarray technologies is expected to increase. Educational campaigns and advocacy groups are playing a crucial role in informing the public about the importance of genetic testing, which may lead to earlier diagnoses and better health outcomes. This heightened awareness is likely to drive market growth, as healthcare providers expand their offerings to include microarray-based tests, thereby catering to the needs of an informed patient population.

Regulatory Developments and Compliance

The regulatory landscape surrounding the US Microarray Market is evolving, with agencies such as the FDA implementing stricter guidelines for the approval and use of microarray technologies. These regulations aim to ensure the safety and efficacy of diagnostic tools, which could potentially enhance consumer confidence in microarray-based tests. Compliance with these regulations may require manufacturers to invest in quality control and validation processes, thereby increasing operational costs. However, adherence to these standards is likely to foster innovation and improve product reliability, ultimately benefiting the market. As regulatory frameworks become more defined, the market may see a surge in new product launches that meet these stringent requirements.

Increased Adoption in Clinical Settings

The US Microarray Market is witnessing a notable increase in the adoption of microarray technologies in clinical settings. Healthcare providers are increasingly utilizing microarrays for personalized medicine, particularly in oncology and genetic testing. The ability to analyze multiple genes simultaneously allows for more accurate diagnoses and tailored treatment plans. According to recent data, the market for clinical microarray applications is expected to reach USD 1.5 billion by 2026, reflecting a growing trend towards precision medicine. This shift is likely to be supported by healthcare policies that promote the use of advanced diagnostic tools, thereby driving further growth in the microarray market.

Technological Advancements in Microarray Technology

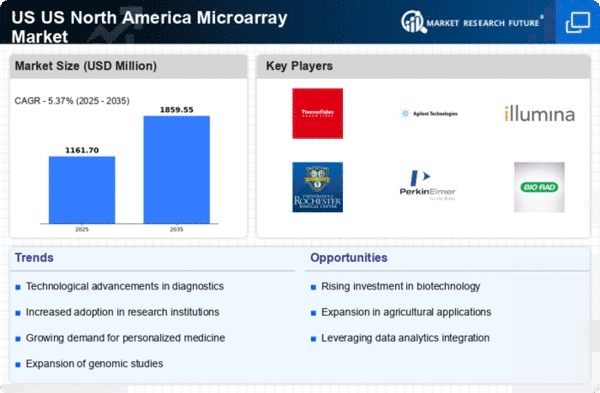

The US Microarray Market is experiencing rapid technological advancements that enhance the capabilities and applications of microarray platforms. Innovations such as next-generation sequencing (NGS) integration and improved data analysis software are driving growth. These advancements allow for higher throughput, greater accuracy, and the ability to analyze complex genomic data more efficiently. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years. Furthermore, the introduction of user-friendly interfaces and automation in microarray systems is likely to increase adoption rates among laboratories and research institutions, thereby expanding the overall market.