Proteases Size

Proteases Market Growth Projections and Opportunities

Various factors have an impact on the Proteases market, which contribute to its dynamics and growth path. One of the main drivers is the growing demand from different sectors such as food and beverages industry, pharmaceuticals industry, and detergents sector. As these industries expand globally, the need for proteases that are enzymes that catalyze the breakdown of proteins into amino acids will also increase proportionately. Food processing is a significant application area where proteases help in improving flavors, textures, nutritional composition of foods. In addition to this, they play a vital role in facilitating production of therapeutic proteins and peptides within the pharmaceutical sector.

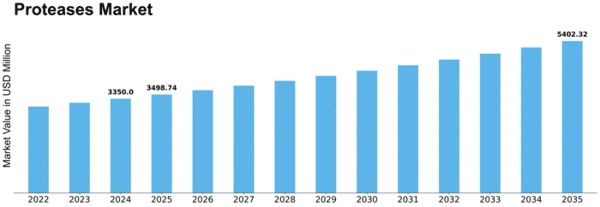

The estimated growth in the proteases market shows CAGR (Compound Annual Growth Rate) at 5.9% making it reach USD 5,770 million by 2030 forecast period.

Additionally, there is considerable contribution by increasing awareness about industrial application of protease towards market growth. Increasingly manufacturers are coming to terms with incorporating proteases into their processes as a way of reducing production costs yet improving efficiency. Because they can operate under mild conditions thus making them suitable for various industrial applications hence promoting their market share expansion thereof. Moreover, continuous advances in biotechnology and molecular biology have led to emergence of new generations of improved characteristics for protease that consequently further boost its market size.

Furthermore, globalization along with international trade greatly affects Proteases market highly. Different companies are now expanding beyond borders implying that there is need for enzymes which could survive diverse environmental conditions as well as meet regulatory needs in place today-looks like those regions when we’ve considered them in isolation again become vital resources for multinational corporations worldwide operating in global markets too much should be avoided if at all possible nowadays class understandings about how enzymes behave differently depending on where they come from instead look towards biotech or genetic engineering technologies enable us make our own customised enzyme products just like everything else out here including what consumers want exactly fits into this space.

Proteases market is not immune to environmental concerns that matter much in today’s business world. The focus is increasing on eco-friendly alternatives as sustainability comes into play. Proteases are biodegradable and their sources are natural, which makes them suitable for many industries’ sustainable objectives. The use of greener and environmentally friendly manufacturing practices is good news for the protease market because firms look at ways through which they can reduce their pollution load without affecting performance.

Despite this, the Proteases market is faced with a number of challenges including: regulatory barriers and high cost of R&D associated with it. Strict regulations governing enzyme usage in some sectors notably food and drug sectors may hinder its entry into such markets thereby slowing down growth rates. Additionally investing consistently on research & development (R&D) aimed at improving enzyme characteristics adds to overall cost of production which may eventually affect the rate at which these markets grow especially during critical times like now.

Leave a Comment