Rising Healthcare Expenditure

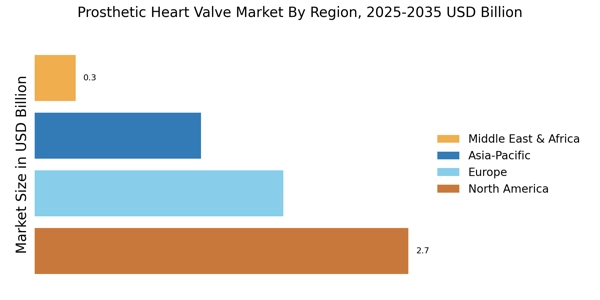

An increase in healthcare expenditure across various regions is likely to bolster the Prosthetic Heart Valve Market. As governments and private sectors allocate more funds towards healthcare, the accessibility of advanced medical treatments, including prosthetic heart valves, improves. This trend is particularly evident in emerging economies, where rising disposable incomes enable patients to seek better healthcare options. The growing willingness to invest in health is expected to drive demand for prosthetic heart valves, as patients prioritize quality of life and longevity. Consequently, the Prosthetic Heart Valve Market stands to benefit from this upward trajectory in healthcare spending.

Awareness and Education on Heart Health

The growing awareness and education regarding heart health are pivotal in driving the Prosthetic Heart Valve Market. Public health campaigns and educational initiatives have increased knowledge about cardiovascular diseases and the importance of timely interventions. As individuals become more informed about their health, they are more likely to seek medical advice and treatment for heart-related issues. This heightened awareness can lead to earlier diagnoses and increased demand for prosthetic heart valves. The Prosthetic Heart Valve Market is thus positioned to grow as more patients recognize the benefits of surgical options for managing heart conditions.

Technological Innovations in Valve Design

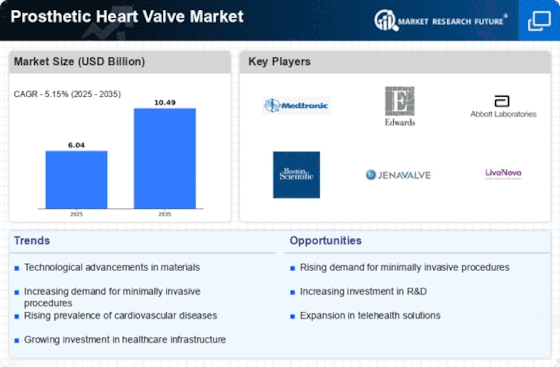

Technological advancements in valve design and materials are significantly influencing the Prosthetic Heart Valve Market. Innovations such as biocompatible materials and minimally invasive surgical techniques enhance the performance and longevity of prosthetic valves. For instance, the introduction of transcatheter aortic valve replacement (TAVR) has revolutionized treatment options for patients with aortic stenosis. These advancements not only improve patient outcomes but also expand the market by attracting a broader patient demographic. As manufacturers continue to invest in research and development, the Prosthetic Heart Valve Market is expected to evolve, offering more sophisticated solutions to healthcare providers.

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases is a primary driver for the Prosthetic Heart Valve Market. As heart conditions become more prevalent, the demand for prosthetic heart valves is likely to increase. According to recent statistics, cardiovascular diseases account for a substantial portion of global mortality rates, necessitating effective treatment options. This trend suggests that healthcare providers are increasingly adopting prosthetic heart valves as a viable solution for patients with severe heart valve disorders. The market is projected to witness growth as more patients seek surgical interventions, thereby propelling the Prosthetic Heart Valve Market forward.

Aging Population and Increased Surgical Interventions

The aging population is a significant factor contributing to the growth of the Prosthetic Heart Valve Market. As life expectancy rises, the incidence of age-related heart conditions increases, leading to a higher demand for surgical interventions. Older adults are more susceptible to heart valve diseases, necessitating the use of prosthetic valves. This demographic shift indicates a potential surge in the number of surgical procedures performed, thereby driving the market. The Prosthetic Heart Valve Market is likely to expand as healthcare systems adapt to the needs of an aging population, ensuring that effective treatment options are available.