Market Growth Projections

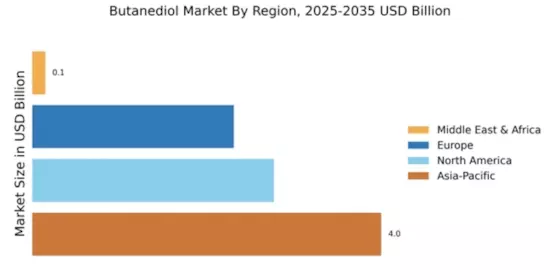

The Global 1, 4-Butanediol Market Industry is projected to experience substantial growth, with forecasts indicating a market size of 21.8 USD Billion by 2035. This growth trajectory reflects the compound's versatility across various applications, including automotive, textiles, and pharmaceuticals. The anticipated compound annual growth rate of 7.6% from 2025 to 2035 suggests that the market will continue to expand as new applications are discovered and existing ones are optimized. This upward trend highlights the increasing importance of 1, 4-Butanediol Market in the global chemical market, positioning it as a critical component in multiple industries.

Expansion in Textile Applications

The Global 1, 4-Butanediol Market Industry is witnessing significant expansion within the textile sector. This compound is utilized in the production of fibers and fabrics, enhancing their strength and elasticity. As consumer preferences shift towards high-performance textiles, the demand for 1, 4-Butanediol Market is expected to grow. The market's potential is underscored by projections indicating a rise to 21.8 USD Billion by 2035, driven by innovations in textile manufacturing processes. This growth reflects a broader trend towards sustainable and functional materials, positioning 1, 4-Butanediol Market as a key player in the evolving textile landscape.

Rising Demand in Automotive Sector

The Global 1, 4-Butanediol Market Industry is experiencing heightened demand driven by the automotive sector. As manufacturers increasingly utilize 1, 4-Butanediol Market in the production of plastics, coatings, and adhesives, the market is projected to reach 9.73 USD Billion in 2024. This growth is attributed to the material's properties, which enhance durability and performance in automotive applications. Furthermore, the shift towards lightweight materials in vehicle design is likely to bolster the demand for 1, 4-Butanediol Market-based products, indicating a robust trajectory for the industry as it adapts to evolving automotive standards.

Growing Pharmaceutical Applications

The Global 1, 4-Butanediol Market Industry is experiencing growth due to its expanding applications in the pharmaceutical sector. 1, 4-Butanediol Market is utilized in the formulation of various drugs and as a solvent in pharmaceutical manufacturing. The increasing focus on healthcare and the development of new medications are likely to drive demand for this compound. As the industry evolves, the integration of 1, 4-Butanediol Market into pharmaceutical processes may enhance drug efficacy and stability. This trend indicates a promising future for the market, as it aligns with the broader healthcare industry's growth trajectory.

Increased Focus on Sustainable Solutions

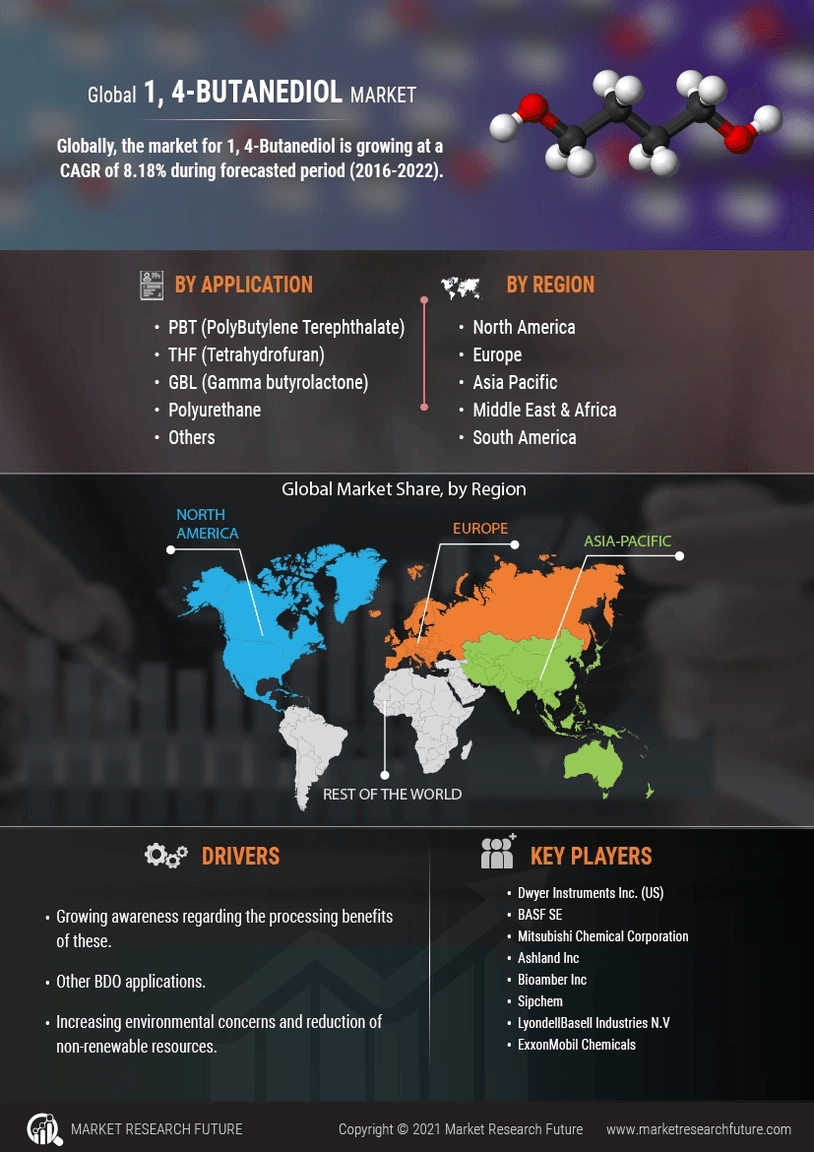

The Global 1, 4-Butanediol Market Industry is increasingly influenced by the global emphasis on sustainability. As industries seek eco-friendly alternatives to traditional chemical processes, 1, 4-Butanediol Market emerges as a viable option due to its biodegradable properties. This shift is likely to attract investments and innovations aimed at developing sustainable production methods. The anticipated compound annual growth rate of 7.6% from 2025 to 2035 suggests that the market will expand as companies align their practices with environmental regulations and consumer expectations. This trend indicates a transformative phase for the industry, where sustainability becomes a core driver of growth.

Technological Advancements in Production

The Global 1, 4-Butanediol Market Industry is benefiting from technological advancements in production methods. Innovations in synthesis processes are enhancing efficiency and reducing costs, making 1, 4-Butanediol Market more accessible to various industries. These advancements are likely to lead to increased production capacities, thereby meeting the rising demand across sectors such as pharmaceuticals and cosmetics. As production becomes more streamlined, the market is expected to see a surge in applications, further solidifying its position in the global chemical landscape. This evolution suggests that the industry is poised for significant growth as it embraces modern manufacturing techniques.