Shift Towards Remote Work

The Professional Services Automation Software Market is witnessing a shift towards remote work, which has become a defining characteristic of modern business operations. As organizations adapt to flexible work environments, the demand for software that supports remote project management and collaboration is on the rise. This shift has led to an increase in the adoption of Professional Services Automation solutions that enable teams to work efficiently from various locations. Data suggests that companies utilizing these tools have seen a 25% improvement in team collaboration and communication. This trend indicates that the Professional Services Automation Software Market is poised for growth as businesses continue to embrace remote work practices.

Growing Need for Efficiency

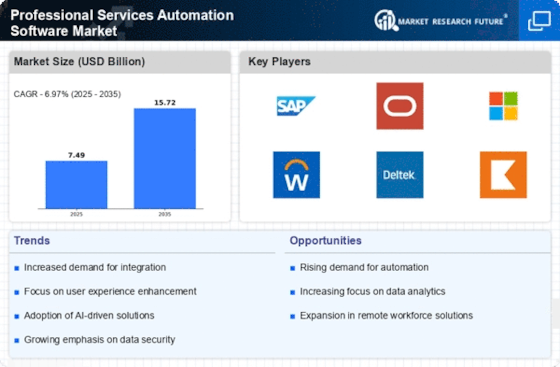

The Professional Services Automation Software Market is experiencing a notable surge in demand for efficiency among organizations. As businesses strive to optimize their operations, the need for streamlined processes becomes paramount. Automation software facilitates the management of resources, time, and projects, thereby enhancing productivity. According to recent data, organizations utilizing such software report a 30% increase in project delivery speed. This trend indicates that companies are increasingly recognizing the value of automation in reducing operational costs and improving service delivery. Consequently, the Professional Services Automation Software Market is likely to expand as more firms seek to implement these solutions to remain competitive.

Rising Demand for Customization

The Professional Services Automation Software Market is characterized by a rising demand for customization in software solutions. Organizations are increasingly seeking tools that can be tailored to their specific needs and workflows. This trend is driven by the recognition that one-size-fits-all solutions often fall short in addressing unique business challenges. As a result, vendors are focusing on offering customizable features that allow clients to adapt the software to their operational requirements. Data indicates that 60% of businesses prefer solutions that can be personalized, suggesting a significant opportunity for growth within the Professional Services Automation Software Market as providers enhance their offerings.

Increased Focus on Data Security

The Professional Services Automation Software Market is increasingly influenced by the heightened focus on data security. As organizations handle sensitive client information, the demand for secure software solutions has intensified. Companies are seeking Professional Services Automation tools that not only enhance operational efficiency but also ensure robust data protection measures. Recent statistics indicate that 70% of firms prioritize security features when selecting automation software. This emphasis on security is likely to drive innovation within the Professional Services Automation Software Market, as vendors strive to meet the evolving needs of their clients while maintaining compliance with regulatory standards.

Integration with Emerging Technologies

The Professional Services Automation Software Market is witnessing a trend towards integration with emerging technologies such as artificial intelligence and machine learning. These technologies offer the potential to enhance the capabilities of Professional Services Automation software, enabling more intelligent decision-making and predictive analytics. As organizations seek to leverage data for strategic advantage, the integration of these technologies becomes increasingly important. Recent findings suggest that companies utilizing AI-driven automation tools experience a 40% increase in operational efficiency. This trend indicates that the Professional Services Automation Software Market is likely to evolve rapidly as businesses adopt innovative solutions to stay ahead in a competitive landscape.