North America : Market Leader in Services

North America leads the Production Equipment Repair and Maintenance Services Market, holding a significant share of 52.1% in 2024. The region's growth is driven by advanced manufacturing technologies, increasing automation, and stringent regulatory standards that demand high-quality maintenance services. The rising need for operational efficiency and reduced downtime further fuels demand, making it a critical market for service providers.

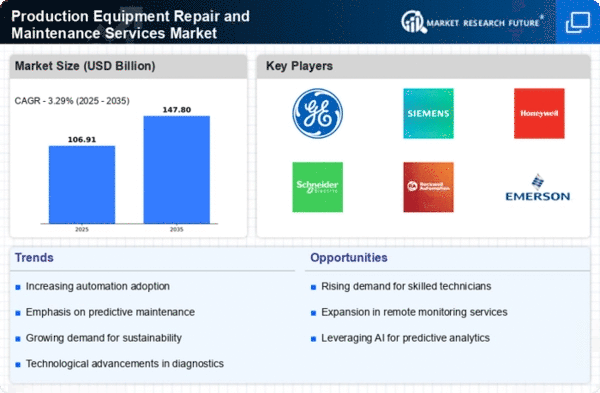

The competitive landscape is robust, with key players like General Electric, Honeywell, and Rockwell Automation dominating the sector. The U.S. stands out as a leader, supported by a strong industrial base and innovation in repair technologies. The presence of major corporations ensures a continuous demand for maintenance services, positioning North America as a pivotal region in the global market.

Europe : Emerging Market Dynamics

Europe's Production Equipment Repair and Maintenance Services Market is valued at €30.0 billion, reflecting a growing demand driven by the region's focus on sustainability and technological advancements. Regulatory frameworks promoting energy efficiency and safety standards are key catalysts for market growth. The increasing complexity of production equipment necessitates specialized repair services, further enhancing market potential.

Leading countries like Germany and France are at the forefront, with companies such as Siemens and Bosch Rexroth playing significant roles. The competitive landscape is characterized by a mix of established players and innovative startups, fostering a dynamic environment. The European market is poised for growth as industries adapt to new technologies and regulatory requirements, ensuring a steady demand for maintenance services.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region, with a market size of $16.0 billion, is rapidly emerging in the Production Equipment Repair and Maintenance Services Market. The growth is fueled by industrialization, urbanization, and increasing investments in manufacturing sectors across countries like China and India. The demand for efficient maintenance services is rising as industries seek to enhance productivity and minimize operational disruptions.

China leads the region, supported by a vast manufacturing base and significant investments in technology. Key players like Mitsubishi Electric and ABB are expanding their presence, contributing to a competitive landscape. As the region continues to evolve, the demand for specialized repair services is expected to grow, driven by technological advancements and regulatory pressures for improved operational standards.

Middle East and Africa : Developing Market Landscape

The Middle East and Africa region, with a market size of $5.4 billion, is gradually developing in the Production Equipment Repair and Maintenance Services Market. The growth is driven by increasing industrial activities and investments in infrastructure. Regulatory initiatives aimed at enhancing operational efficiency and safety standards are also contributing to market expansion, as industries seek reliable maintenance solutions.

Countries like South Africa and the UAE are leading the way, with a growing number of local and international players entering the market. The competitive landscape is evolving, with companies focusing on innovative repair solutions to meet the unique demands of the region. As industries continue to grow, the need for effective maintenance services will become increasingly critical, positioning the region for future growth.