Expansion of End-Use Industries

The expansion of end-use industries is a critical driver for the Production Chemical Market. Sectors such as automotive, construction, and electronics are experiencing robust growth, leading to increased demand for various chemicals. For example, the automotive industry is increasingly utilizing advanced materials and coatings, which in turn drives the need for specialized production chemicals. Market forecasts suggest that the demand from end-use industries could propel the Production Chemical Market to reach a valuation of over 1 trillion dollars by 2030. This expansion not only creates opportunities for existing players but also attracts new entrants, thereby intensifying competition within the industry.

Rising Demand for Specialty Chemicals

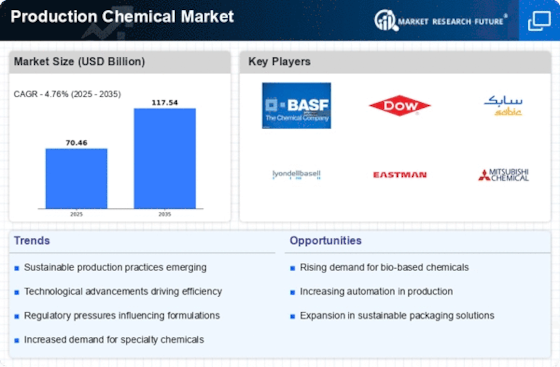

The Production Chemical Market experiences a notable increase in demand for specialty chemicals, driven by their unique properties and applications across various sectors. Industries such as pharmaceuticals, agriculture, and personal care are increasingly utilizing specialty chemicals to enhance product performance and meet consumer expectations. According to recent data, the specialty chemicals segment is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years. This growth is indicative of a broader trend within the Production Chemical Market, where customization and innovation are paramount. As companies strive to differentiate their offerings, the focus on specialty chemicals is likely to intensify, thereby shaping the competitive landscape of the industry.

Growing Focus on Sustainable Practices

The Production Chemical Market is witnessing a growing focus on sustainable practices, as stakeholders increasingly prioritize environmental responsibility. Companies are adopting green chemistry principles to minimize waste and reduce the environmental impact of chemical production. This shift is not only driven by regulatory pressures but also by consumer demand for sustainable products. Market data indicates that the sustainable chemicals segment is expected to grow at a rate of 6% annually, reflecting a broader trend towards sustainability in the Production Chemical Market. As businesses align their strategies with sustainability goals, they are likely to enhance their brand reputation and attract environmentally conscious consumers.

Regulatory Compliance and Safety Standards

The Production Chemical Market is significantly influenced by stringent regulatory compliance and safety standards. Governments and regulatory bodies are increasingly enforcing regulations aimed at ensuring the safe production and use of chemicals. This trend compels manufacturers to invest in compliance measures, which may include adopting safer production processes and utilizing environmentally friendly materials. The implementation of such regulations not only enhances safety but also promotes sustainability within the Production Chemical Market. As a result, companies that prioritize compliance are likely to gain a competitive edge, as consumers and businesses alike become more conscious of safety and environmental impact.

Innovations in Chemical Manufacturing Processes

Innovations in chemical manufacturing processes are reshaping the Production Chemical Market. Advances in technology, such as automation and digitalization, are streamlining production, reducing costs, and improving efficiency. For instance, the adoption of Industry 4.0 principles allows for real-time monitoring and optimization of production processes. This technological evolution is expected to enhance the overall productivity of the Production Chemical Market, with estimates suggesting a potential increase in output by 20% over the next decade. Furthermore, these innovations facilitate the development of new products, thereby expanding market opportunities and driving growth.