Integration of IoT Technologies

The integration of Internet of Things (IoT) technologies is reshaping the production information-management market. IoT devices enable manufacturers to collect vast amounts of data from machinery and equipment, facilitating predictive maintenance and operational insights. Current estimates suggest that the IoT market in manufacturing could reach $200 billion by 2026, with a substantial portion allocated to production information-management solutions. This integration allows for enhanced monitoring and control of production processes, leading to improved quality and reduced downtime. As manufacturers increasingly adopt IoT technologies, the production information-management market is likely to witness accelerated growth, driven by the demand for smarter, data-driven operations.

Emphasis on Operational Efficiency

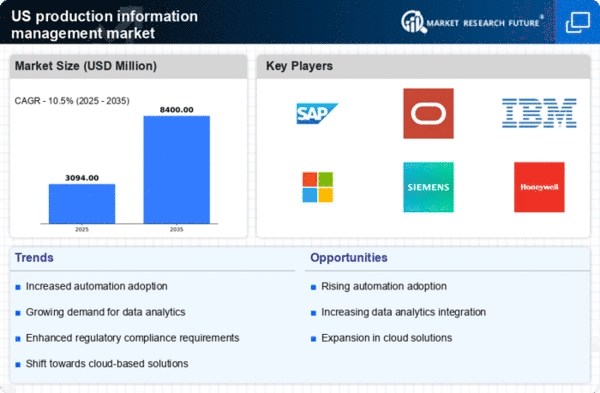

Operational efficiency remains a critical driver in the production information-management market. Companies are increasingly focused on streamlining processes to reduce costs and enhance productivity. Recent studies indicate that organizations implementing advanced production information-management solutions can achieve efficiency gains of up to 30%. This drive for efficiency is prompting investments in automation and data integration technologies, which are essential for optimizing workflows. As manufacturers seek to eliminate bottlenecks and improve resource allocation, the production information-management market is likely to see a compound annual growth rate (CAGR) of 12% over the next five years. This trend highlights the necessity for robust systems that can support continuous improvement initiatives.

Focus on Sustainability and Compliance

Sustainability and compliance are emerging as pivotal drivers in the production information-management market. As regulatory pressures increase, manufacturers are compelled to adopt practices that align with environmental standards. Approximately 75% of companies are investing in systems that ensure compliance with sustainability regulations, which is reshaping their production strategies. This focus on sustainability not only addresses regulatory requirements but also enhances brand reputation and customer loyalty. The production information-management market is expected to benefit from this trend, with investments in sustainable technologies projected to exceed $3 billion by 2025. This shift underscores the necessity for systems that can effectively manage compliance and sustainability initiatives.

Rising Demand for Real-Time Data Access

The production information-management market is experiencing a notable surge in demand for real-time data access. This trend is driven by the need for manufacturers to make informed decisions quickly, enhancing operational efficiency. In the current landscape, approximately 70% of organizations prioritize real-time data capabilities to optimize production processes. The ability to access and analyze data instantaneously allows companies to respond to market changes and customer needs more effectively. As a result, investments in technologies that facilitate real-time data access are expected to grow, potentially reaching $5 billion by 2027. This shift underscores the importance of agile production information-management systems that can support dynamic decision-making.

Growing Importance of Supply Chain Visibility

Supply chain visibility is becoming increasingly vital in the production information-management market. With the complexities of modern supply chains, organizations are seeking solutions that provide comprehensive insights into their operations. Approximately 60% of manufacturers report that enhanced visibility leads to better inventory management and reduced lead times. This growing emphasis on transparency is driving the adoption of technologies that facilitate real-time tracking and data sharing across the supply chain. As companies strive to mitigate risks and improve collaboration with suppliers, the production information-management market is expected to expand significantly, with projections indicating a market size of $10 billion by 2028.