Market Analysis

In-depth Analysis of Procurement Software Market Industry Landscape

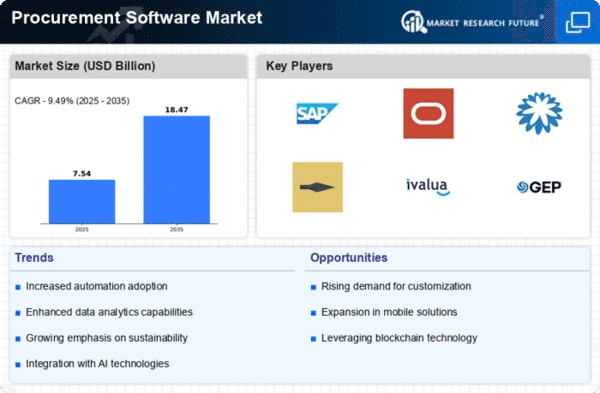

The procurement software market is experiencing dynamic shifts driven by the evolving needs of businesses in the modern era. As organizations increasingly recognize the importance of efficient procurement processes, the demand for advanced procurement software has surged. Market dynamics in this sector are shaped by several key factors, including technological advancements, globalization, and a growing emphasis on cost optimization.

Technological innovations play a pivotal role in shaping the procurement software market landscape. With the advent of artificial intelligence (AI) and machine learning (ML), procurement solutions have become more sophisticated, offering enhanced automation, predictive analytics, and real-time insights. These technological advancements empower organizations to streamline their procurement workflows, reduce manual intervention, and make data-driven decisions. As a result, businesses are actively seeking procurement software that not only meets their current needs but also aligns with the future trajectory of technological progress.

Globalization has also been a driving force in shaping the market dynamics of procurement software. As businesses expand their operations across borders, the need for centralized and standardized procurement processes becomes imperative. Procurement software enables organizations to manage their sourcing, supplier relationships, and purchasing activities on a global scale, fostering consistency and efficiency. This trend is particularly evident in large enterprises and multinational corporations seeking unified solutions to navigate the complexities of diverse regulatory environments and supply chain networks.

Cost optimization remains a key focus for businesses, driving the adoption of procurement software to achieve better financial efficiency. Organizations recognize the potential of these solutions to enhance cost visibility, negotiate favorable terms with suppliers, and identify opportunities for savings. The dynamic nature of the market is reflected in the continuous evolution of procurement software functionalities, with vendors actively incorporating features such as spend analysis, contract management, and supplier collaboration to address the multifaceted aspects of cost management.

Moreover, the procurement software market is witnessing a shift towards cloud-based solutions. Cloud deployment offers scalability, flexibility, and accessibility, allowing businesses to adapt to changing requirements and access procurement tools from anywhere with an internet connection. This shift is driven by the desire for cost-effective solutions that reduce the burden of maintaining on-premise infrastructure while providing seamless integration with other enterprise systems.

The competitive landscape of the procurement software market is marked by a diverse range of vendors, each offering unique features and capabilities. Market players are engaged in strategic partnerships, acquisitions, and continuous product enhancements to stay ahead in this competitive space. As a result, buyers are presented with a wide array of options, contributing to the dynamic nature of procurement software procurement.

Leave a Comment