Top Industry Leaders in the Procurement Software Market

Competitive Landscape of Procurement Software Market

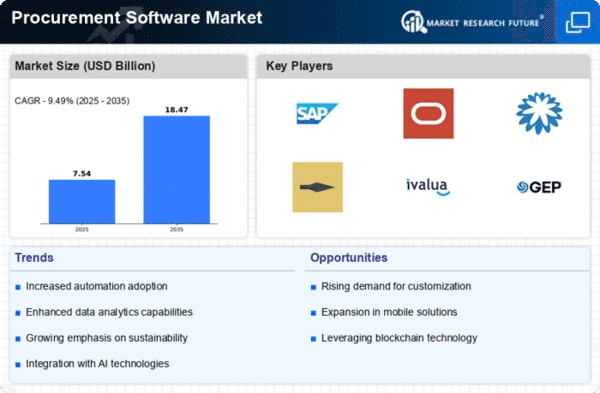

The procurement software market is a rapidly growing and dynamic space, fueled by increasing demand for automation, cost savings, and improved supply chain visibility. This report delves into the competitive landscape, highlighting key players, their strategies, and factors influencing market share analysis. Additionally, it explores emerging companies and current investment trends in the sector.

Key Players:

- Epicor Software Corporation (U.S.)

- JDA Software Inc. (U.S.)

- Zycus Inc. (U.S.)

- SAP SE (Germany)

- Mercateo AG (Germany)

- Oracle Corporation (U.S.)

- Infor Inc. (U.S.)

- IBM Corporation (U.S.)

Strategies Adopted by Key Players:

To stay ahead of the curve, key players are adopting various strategies, including:

- Product Development: Continuous innovation and development of cutting-edge features like AI-powered spend analytics, machine learning for supplier risk management, and integration with emerging technologies like blockchain.

- Strategic Partnerships: Collaboration with technology providers, consulting firms, and industry associations to expand their reach, acquire new expertise, and access new markets.

- Market Expansion: Geographic expansion through mergers and acquisitions, partnerships, and organic growth strategies targeting untapped markets.

- Targeting Specific Segments: Focusing on specific industry segments or customer size categories with tailored solutions and marketing campaigns.

- Subscription-Based Model: Transitioning from traditional licensing models to subscription-based pricing to offer flexible and scalable solutions for customers.

Factors for Market Share Analysis:

Several factors play a crucial role in determining market share in the procurement software market:

- Product Portfolio Breadth and Depth: Comprehensive suite of solutions addressing various procurement needs, including e-procurement, spend analytics, supplier management, and contract management.

- Scalability and Flexibility: Ability to cater to diverse customer needs across different industries and organizational sizes.

- Technology Innovation: Demonstrated commitment to innovation and development of next generation features and functionalities.

- Customer Satisfaction and Service: High customer satisfaction ratings and strong track record of delivering exceptional service and support.

- Brand Reputation and Market Recognition: Established brand name and positive recognition within the industry.

New and Emerging Companies:

Several new and emerging companies are entering the market with innovative solutions and niche offerings. These companies are primarily focusing on:

- Cloud-based solutions: Offering cost-effective and scalable solutions with minimal infrastructure requirements.

- Specialized solutions: Targeting specific procurement challenges like supplier risk management, spend optimization, or contract management.

- User-friendly interfaces: Designing intuitive and user-friendly interfaces to improve adoption and user experience.

- Focus on specific industries: Tailoring solutions to specific industry needs and regulations.

Current Company Investment Trends:

Current company investment trends in the procurement software market include:

- Emerging Technologies: Investing in technologies like AI, machine learning, blockchain, and IoT to enhance automation, improve data analysis, and optimize procurement processes.

- Cloud Adoption: Increasing focus on cloud-based solutions due to their scalability, flexibility, and reduced infrastructure costs.

- Industry-Specific Solutions: Tailoring solutions to specific industry needs and regulations to address unique challenges and compliance requirements.

- User Experience: Investing in user-friendly interfaces, improved mobile accessibility, and user training programs to enhance user adoption and satisfaction.

- Strategic Partnerships: Collaborating with technology providers, consulting firms, and industry associations to gain access to new markets, expertise, and resources.

Latest Company Updates:May, 2023

Amazon Business introduces a new mobile app-based procurement solution in 2023. Buyers can complete purchase orders on a mobile device with the new 3-Way Match feature of the Amazon Business mobile app. A new tool available to Amazon Business buyers speeds up purchase order reconciliation without the use of a desktop computer or handheld scanner.

In order to assist customers in keeping track of their tool and equipment inventory across their operations, Kojo, the top materials and inventory management platform for the construction industry, today announced the debut of Kojo Tool Tracking in 2023.