Growing Need for Regulatory Compliance

The Process Mining Software Market is increasingly driven by the growing need for regulatory compliance across various industries. Organizations are under constant pressure to adhere to stringent regulations and standards, which necessitates the implementation of robust compliance measures. Process mining software assists companies in monitoring their processes to ensure compliance with legal and regulatory requirements. Recent findings indicate that non-compliance can result in penalties amounting to millions of dollars, highlighting the importance of effective compliance management. As businesses seek to mitigate risks associated with non-compliance, the demand for process mining solutions is expected to rise. This trend underscores the critical role of process mining software in helping organizations navigate the complexities of regulatory landscapes, thereby fueling growth in the Process Mining Software Market.

Emphasis on Data-Driven Decision Making

The Process Mining Software Market is witnessing a paradigm shift towards data-driven decision making, which is becoming increasingly vital for organizations aiming to remain competitive. Companies are leveraging data analytics to gain insights into their operations, and process mining software plays a crucial role in this transformation. By analyzing event logs and process data, organizations can uncover patterns and trends that inform strategic decisions. Recent statistics suggest that organizations utilizing data-driven approaches are 5 times more likely to make faster decisions than their competitors. This emphasis on data analytics is likely to propel the adoption of process mining solutions, as businesses recognize the need for tools that facilitate informed decision making. As a result, the Process Mining Software Market is poised for substantial growth in the coming years.

Rising Complexity of Business Processes

The Process Mining Software Market is significantly influenced by the increasing complexity of business processes across various sectors. As organizations expand and diversify their operations, the intricacies of their processes grow, making it challenging to maintain oversight and control. Process mining software provides a solution by offering insights into these complex workflows, enabling organizations to streamline operations and enhance performance. According to recent data, approximately 70% of organizations report difficulties in managing their processes effectively due to this complexity. Consequently, the demand for process mining solutions is expected to rise, as companies seek tools that can simplify their operations and provide clarity. This trend indicates a robust growth trajectory for the Process Mining Software Market as businesses prioritize effective process management.

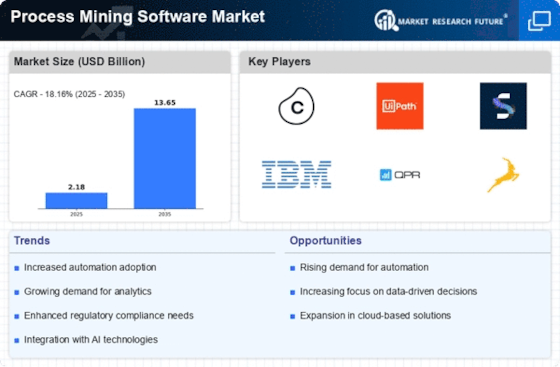

Increased Demand for Operational Efficiency

The Process Mining Software Market experiences a notable surge in demand as organizations strive for enhanced operational efficiency. Companies are increasingly recognizing the value of process mining in identifying inefficiencies and bottlenecks within their workflows. This trend is underscored by a report indicating that organizations utilizing process mining tools can achieve up to a 30% reduction in operational costs. As businesses seek to optimize their processes, the adoption of process mining software is likely to accelerate, driving growth in the market. Furthermore, the ability to visualize and analyze complex processes in real-time empowers organizations to make informed decisions, thereby enhancing overall productivity. This growing emphasis on efficiency is a key driver propelling the Process Mining Software Market forward.

Advancements in Technology and Integration Capabilities

The Process Mining Software Market is significantly influenced by advancements in technology and the integration capabilities of process mining solutions. As technology evolves, process mining software is becoming more sophisticated, offering enhanced features such as real-time analytics and machine learning capabilities. These advancements enable organizations to gain deeper insights into their processes and make proactive adjustments. Furthermore, the ability to integrate process mining tools with existing enterprise systems, such as ERP and CRM platforms, enhances their utility and effectiveness. Recent data suggests that organizations that integrate process mining with other technologies can achieve up to a 25% improvement in process efficiency. This trend indicates a promising future for the Process Mining Software Market, as businesses increasingly seek advanced solutions that can seamlessly integrate with their operational frameworks.