Market Trends

Key Emerging Trends in the Private LTE Market

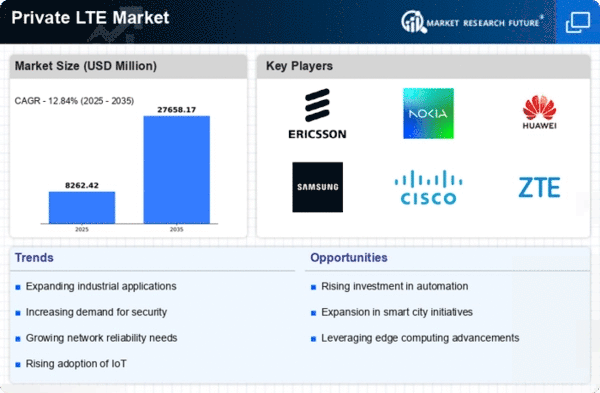

Strong tendencies in the private LTE market indicate its growing importance in remote correspondence. Company need for reliable and secure availability has led to the popularity of private LTE networks. Assembly, medical care, and transportation are all seeing increased adoption in this market. Private LTE helps these locations satisfy their communication needs, enabling constant tasks and increased efficiency.

Private LTE organizations have seen a surge in IIoT applications. Since current cycles necessitate ongoing information exchange and computerization, private LTE provides a strong, low-idleness communication foundation. This has brought smart devices, sensors, and other IIoT pieces together, boosting the private LTE market.

Furthermore, private LTE networks in basic foundation projects are gaining attention. Power, utilities, and public health are seeing the benefits of reliable and secure communication. Private LTE ensures reliable availability in rural or vital regions, boosting government flexibility and response.

The private LTE industry is also affected by 5G technology. As 5G companies expand abroad, private LTE is seen as a stepping stone. Many organizations are investing in private LTE networks to prepare for the eventual switch to 5G and future-proof their networks.

Security is a major concern in the technological era, including the private LTE market. To overcome security and protection issues with public organizations, more projects are using private LTE organizations. Private LTE lets companies control their communication system and protect sensitive data and exchanges.

Organization cutting is also gaining ground in private LTE. Network cutting allows several virtual companies to be created inside a single company, each tailored to certain applications or customer groups. This flexibility streamlines resources for low-dormancy applications to large machine-type correspondences, improving private LTE network efficiency.

Leave a Comment