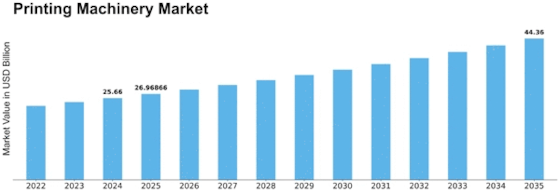

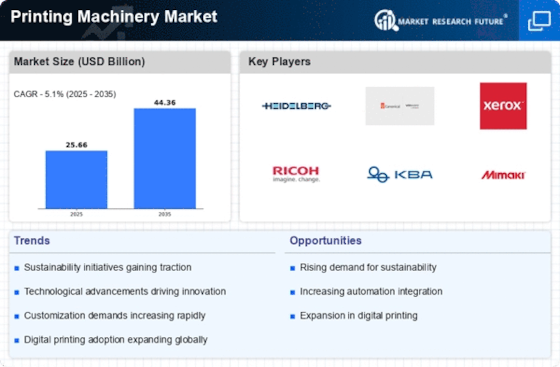

Printing Machinery Size

Printing Machinery Market Growth Projections and Opportunities

The development and patterns of the printing machinery market are formed by a broad cluster of market factors, delivering it a unique area. This business is largely driven by technological advancements. The market is essentially impacted by the ceaseless advancement of printing innovation, which envelops headways in computerized printing, robotization, and further developed functionalities. The interest for cutting edge printing contraption stays high as associations endeavour to execute more smoothed out and affordable cycles.

Moreover, financial circumstances essentially affect the improvement of the printing apparatus market. Very delicate to variances in worldwide economies is the market. Businesses frequently put off purchasing new printing equipment during times of economic recession, which causes a brief market slowdown. Then again, periods of monetary extension commonly motivate organizations to put resources into modernized and complex printing gear to keep an upper hand.

As of late, ecological worries have arisen as a significant determinant influencing the market for printing hardware. As ecological effect and supportability become all the more broadly perceived, the interest for energy-productive and earth ideal printing arrangements increments. Accordingly, makers inside the area are attempted the turn of events and advancement of apparatus that utilizes energy-proficient practices, limits squander, and uses naturally positive materials. This shift toward sustainability is in line with consumer preferences and regulatory requirements that encourage the use of green technologies.

An extra critical market factor that impacts the printing hardware market is globalization. As endeavors widen their procedure on a worldwide scale, the interest for printing arrangements that are both productive and of better quality increments than oblige the shifted needs of business sectors. This peculiarity has brought about a more prominent commonness of modern printing gear that is able to do quickly and exactly creating a great many pieces of literature. Besides, there has been an expansion in the requirement for printing hardware that has multifunctional abilities, as endeavors endeavor to give versatile arrangements that can oblige different business sectors and shopper requests.

Printing machinery markets are also significantly impacted by regulatory policies. Printing apparatus plan and creation are impacted by thorough guidelines relating to discharges, quality control, and security norms. To achieve market acknowledgment and guarantee that their items fulfill the vital guidelines, makers are committed to comply to these guidelines. Consistence with administrative rules not just ensures the trustworthiness and constancy of printing hardware yet additionally develops client certainty and reinforces the remaining of the printing business.

Market competition is a constant driver of innovation and productivity in the printing machinery market. To stay cutthroat on the lookout and gain a bigger part of the market, makers are obliged to develop, further develop item credits, and proposition serious evaluating. This opposition furnishes buyers with a wide exhibit of printing hardware decisions, each having one-of-a-kind functionalities and cost levels.

The market for printing machinery dynamic and complex area that is impacted by a huge number of market factors. The market's development and direction are by and large impacted by mechanical headways, monetary circumstances, natural contemplations, globalization, administrative approaches, and market rivalry. Makers should handily explore these variables in the midst of the continuous development of the business to keep up with seriousness and fulfill the moving requests of organizations on a worldwide scale.

Leave a Comment