Market Analysis

In-depth Analysis of Printing Machinery Market Industry Landscape

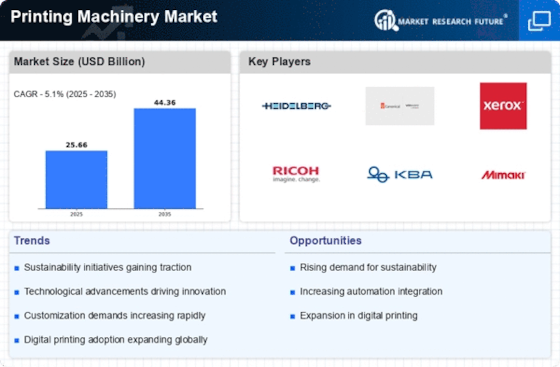

The print machinery market is constantly changing and vibrant and is extremely important to many industries around the world. The dynamics of this market is influenced by several factors that determine the trajectory of expansion, the competitive landscape and the prevailing patterns. Rapid technical development in the printing production is a major factor fuelling the printing equipment market. The endless development of digital printing has led to a raising demand for even more resourceful and competent printing equipment. Innovations like inkjet & laser printing, which opens room for customization, quicker response times and augmented print quality, are the result of the move towards digital printing. This technological development is one of the main drivers behind the market and expansion. Environmental factors are increasingly influencing the dynamics of the printing machinery market. The growing familiarity of companies and consumers concerning sustainability has led to a more focus on environmentally aware printing solutions. Consequently, energy saving tools, environmentally friendly pigment compositions and waste reduction strategies have been considered when designing printing equipment with ecological sustainability in mind. Companies that can approach eco-friendly printing options are likely to stay ahead. Alterations in consumer behaviour & preferences also alter market dynamics. The need for exceptional and distinct products increases the mandate for printed products that can be tailored and personalized. Printer manufacturers are retorting to this trend by developing tools that makes it simple to amend promotional material, packaging & other printed products. Manufacturers compete for market share and innovation leadership in the printing machinery market. There is immense competition out there. Companies often utilize mergers, acquisitions as well as strategic alliances for expanding their product lines and bracing their market position. In addition, upholding a competitive gain in the active market call for a firm commitment to R&D. Government laws and regulations affect printing equipment market dynamics. Environmental legislation, trade regulations, & safety standards can alter product design, manufacturing practices and market entry. Companies must stay abreast of the legislative changes to guarantee compliance and cut risk. There are untold players in the, from SMEs to large international firms. Many factors induce the market and its heterogeneity, including financial factors, regional differences in market conditions & cultural preferences. Understanding and adapting to these local idiosyncrasies is essential to success in the global printing machinery market. Market dynamics of Printing Equipment are shaped by several factors, including technological progresses, environmental factors, consumer preferences, economic conditions, government regulations, competition, & regional differences. To remain competitive and take plus of new opportunities in this vigorously changing market, manufacturers and other industry participants must positively navigate these dynamics.

Leave a Comment