Increased Awareness and Education

The growing awareness and education surrounding maternal health issues are pivotal in shaping the Preterm Birth and PROM Testing Market. Campaigns aimed at educating expectant mothers about the risks associated with preterm births and the importance of early detection are gaining traction. This heightened awareness is likely to lead to increased demand for testing services, as more women seek proactive measures to ensure healthy pregnancies. Furthermore, healthcare providers are increasingly prioritizing patient education as part of their standard care protocols, which may further drive the adoption of PROM testing. As awareness continues to rise, the Preterm Birth and PROM Testing Market is expected to benefit from a more informed patient population that actively engages in their prenatal care.

Regulatory Support and Guidelines

Regulatory support and the establishment of guidelines for prenatal care are influential factors in the Preterm Birth and PROM Testing Market. Governments and health organizations are increasingly recognizing the need for standardized protocols to address the challenges associated with preterm births. This regulatory framework not only encourages the adoption of best practices in maternal care but also fosters innovation in testing methodologies. For example, guidelines that promote the use of specific biomarkers for early detection of PROM can lead to increased investment in research and development. As regulatory bodies continue to advocate for improved maternal health outcomes, the Preterm Birth and PROM Testing Market is likely to experience growth driven by compliance with these evolving standards.

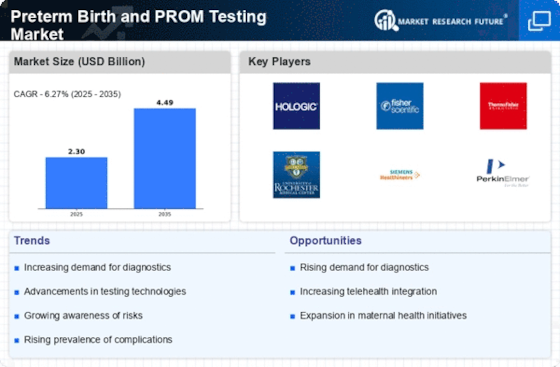

Rising Incidence of Preterm Births

The increasing incidence of preterm births is a critical driver for the Preterm Birth and PROM Testing Market. Recent statistics indicate that approximately 15 million infants are born preterm each year, which represents a significant public health concern. This rise in preterm births necessitates the development and implementation of effective testing methods to identify at-risk pregnancies. As healthcare providers seek to mitigate the risks associated with preterm deliveries, the demand for reliable PROM testing solutions is likely to grow. This trend underscores the importance of investing in innovative technologies and methodologies that can enhance prenatal care and improve outcomes for both mothers and infants. Consequently, the Preterm Birth and PROM Testing Market is poised for expansion as stakeholders respond to this pressing need.

Advancements in Diagnostic Technologies

Technological advancements in diagnostic tools are transforming the landscape of the Preterm Birth and PROM Testing Market. Innovations such as point-of-care testing and non-invasive methods are enhancing the accuracy and speed of diagnosing preterm labor and premature rupture of membranes. For instance, the introduction of biomarkers and molecular diagnostics has shown promise in identifying at-risk pregnancies earlier than traditional methods. This evolution in testing technology not only improves patient outcomes but also streamlines clinical workflows, making it easier for healthcare providers to manage high-risk cases. As these technologies continue to evolve, they are expected to drive growth in the Preterm Birth and PROM Testing Market, as more healthcare facilities adopt these advanced solutions to enhance maternal and fetal health.

Growing Investment in Maternal Health Research

The surge in investment directed towards maternal health research is a significant driver for the Preterm Birth and PROM Testing Market. Funding from both public and private sectors is increasingly being allocated to studies focused on understanding the causes and consequences of preterm births. This financial support is crucial for developing new testing methods and improving existing ones, thereby enhancing the overall quality of prenatal care. Research initiatives that explore innovative approaches to predict and manage preterm labor are likely to yield valuable insights, which can subsequently be translated into practical applications within the healthcare system. As investment in maternal health research continues to grow, the Preterm Birth and PROM Testing Market stands to benefit from the advancements and discoveries that emerge from these efforts.