Growth of Renewable Energy Sector

The Pressure Control Equipment Market is witnessing growth due to the expansion of the renewable energy sector. As countries invest in sustainable energy sources such as wind and solar, the need for reliable pressure control systems becomes paramount. These systems are essential for managing the variable nature of renewable energy production, ensuring stability and efficiency. The market for pressure control equipment in renewable applications is expected to grow by approximately 20% over the next few years, reflecting the increasing integration of renewable sources into the energy mix. This trend indicates a shift towards more sustainable practices within the Pressure Control Equipment Market.

Regulatory Compliance and Safety Standards

The Pressure Control Equipment Market is significantly influenced by stringent regulatory compliance and safety standards. Governments and regulatory bodies are increasingly mandating the use of advanced pressure control systems to ensure safety in various sectors, including energy and manufacturing. Compliance with these regulations not only mitigates risks but also enhances operational efficiency. The market is expected to see a rise in demand for equipment that meets these standards, with an estimated growth rate of 15% in the next few years. This trend underscores the importance of safety and compliance in the Pressure Control Equipment Market.

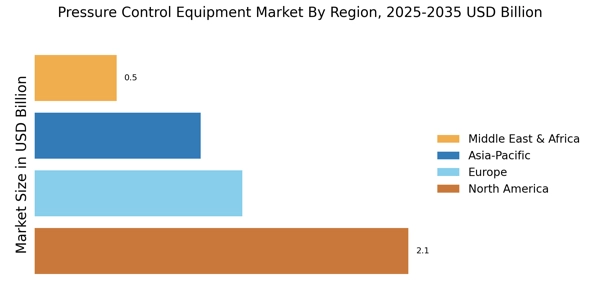

Rising Energy Demand and Resource Management

The Pressure Control Equipment Market is driven by the rising energy demand and the need for efficient resource management. As populations grow and industrial activities expand, the demand for energy continues to escalate. This has led to an increased focus on optimizing pressure control systems to enhance energy efficiency and reduce waste. The market is projected to grow at a compound annual growth rate of 10%, driven by the need for effective pressure management in energy production and distribution. This trend highlights the critical role of pressure control equipment in meeting energy demands within the Pressure Control Equipment Market.

Increased Investment in Infrastructure Development

The Pressure Control Equipment Market is benefiting from increased investment in infrastructure development across various sectors. Governments and private entities are allocating substantial resources to enhance infrastructure, particularly in energy, water, and transportation. This investment is likely to drive demand for advanced pressure control systems that ensure operational efficiency and safety. The market is anticipated to grow by 12% as infrastructure projects necessitate the implementation of reliable pressure management solutions. This trend emphasizes the critical role of pressure control equipment in supporting infrastructure development within the Pressure Control Equipment Market.

Technological Innovations in Pressure Control Equipment

The Pressure Control Equipment Market is experiencing a surge in technological innovations that enhance efficiency and reliability. Advanced materials and smart technologies are being integrated into pressure control systems, allowing for real-time monitoring and automated adjustments. This trend is likely to improve operational safety and reduce downtime, which is crucial for industries such as oil and gas, chemical processing, and water management. According to recent data, the adoption of smart pressure control solutions is projected to grow by over 25% in the next five years, indicating a strong shift towards automation and digitalization in the Pressure Control Equipment Market.