Market Growth Projections

The Global Prepaid Cards Market Industry is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 26.14% from 2025 to 2035. This growth trajectory suggests a robust demand for prepaid card solutions across various sectors, including retail, travel, and corporate payments. The increasing reliance on digital payment methods and the expansion of e-commerce are likely to contribute to this upward trend. As the market evolves, stakeholders can expect to see a diversification of prepaid card offerings, catering to a broader range of consumer needs.

Evolving Consumer Preferences

Consumer preferences are evolving, leading to a shift in the Global Prepaid Cards Market Industry. The demand for flexible payment options is rising, as consumers seek alternatives to credit and debit cards. Prepaid cards offer a controlled spending mechanism, appealing to budget-conscious individuals. Additionally, the ability to load funds and use them for specific purposes, such as travel or online shopping, enhances their attractiveness. This trend is likely to drive market growth, as more consumers opt for prepaid solutions that align with their financial management strategies.

Increased Financial Inclusion

Financial inclusion remains a critical driver for the Global Prepaid Cards Market Industry. Prepaid cards provide unbanked and underbanked populations with access to financial services. By offering a means to make transactions without the need for a traditional bank account, these cards empower individuals to participate in the economy. Governments and organizations worldwide are promoting financial literacy and access, which enhances the uptake of prepaid cards. This trend is expected to contribute significantly to market growth, as more individuals recognize the benefits of having a prepaid card for everyday transactions.

Regulatory Support and Compliance

Regulatory support and compliance are essential drivers for the Global Prepaid Cards Market Industry. Governments are increasingly recognizing the importance of prepaid cards in promoting financial inclusion and consumer protection. Regulatory frameworks are being established to ensure transparency and security in prepaid card transactions. This supportive environment encourages financial institutions to innovate and offer diverse prepaid card products. As regulations evolve, they are likely to foster a more competitive market landscape, which could lead to enhanced offerings and increased consumer adoption.

Rising Adoption of Digital Payment Solutions

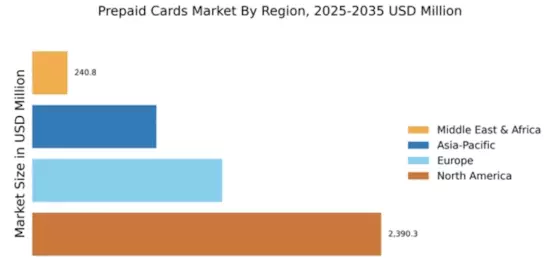

The Global Prepaid Cards Market Industry experiences a notable increase in the adoption of digital payment solutions. As consumers increasingly prefer cashless transactions, prepaid cards serve as a convenient alternative. In 2024, the market is projected to reach 1.19 USD Billion, reflecting a growing trend towards digital wallets and online shopping. This shift is particularly evident among younger demographics who favor the ease of use and security that prepaid cards offer. The proliferation of smartphones and mobile banking applications further facilitates this transition, indicating a robust future for the prepaid card sector.

Technological Advancements in Payment Systems

Technological advancements play a pivotal role in shaping the Global Prepaid Cards Market Industry. Innovations in payment processing and security technologies enhance the functionality and safety of prepaid cards. Contactless payment options, mobile integration, and enhanced fraud protection measures are becoming standard features. These advancements not only improve user experience but also build consumer trust in prepaid card solutions. As technology continues to evolve, it is anticipated that the market will expand significantly, with projections indicating a growth to 15.3 USD Billion by 2035, driven by these innovations.