Premium Cosmetics Market Summary

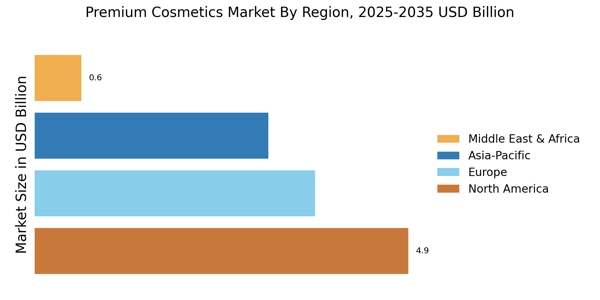

As per Market Research Future analysis, the Premium Cosmetics Market was estimated at 12.2 USD Billion in 2024. The Premium Cosmetics industry is projected to grow from 12.98 USD Billion in 2025 to 24.04 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.36% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Premium Cosmetics Market is experiencing a dynamic shift towards sustainability and personalization, driven by evolving consumer preferences.

- Sustainability and ethical sourcing are becoming paramount in consumer purchasing decisions, particularly in North America.

- Personalization and customization of products are increasingly sought after, especially within the face products segment.

- Influencer marketing and social media engagement are significantly shaping brand visibility and consumer choices in the Asia-Pacific region.

- Rising disposable incomes and the growing demand for anti-aging products are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 12.2 (USD Billion) |

| 2035 Market Size | 24.04 (USD Billion) |

| CAGR (2025 - 2035) | 6.36% |

Major Players

L'Oreal (FR), Estée Lauder (US), Chanel (FR), Dior (FR), Shiseido (JP), Lancôme (FR), Guerlain (FR), Clarins (FR), Givenchy (FR), Armani (IT)