Rising Cybersecurity Concerns

As the Power System State Estimator Market evolves, the rising concerns regarding cybersecurity are becoming a critical driver. With the increasing digitization of power systems, the risk of cyber threats poses significant challenges to grid security and reliability. Utilities are compelled to invest in state estimation solutions that incorporate robust cybersecurity measures to protect sensitive data and ensure uninterrupted service. The Power System State Estimator Market for energy is expected to grow at a rate of 15% annually, reflecting the urgency of addressing these threats. This trend indicates that the Power System State Estimator Market will likely see a surge in demand for solutions that prioritize cybersecurity alongside operational efficiency.

Integration of Advanced Technologies

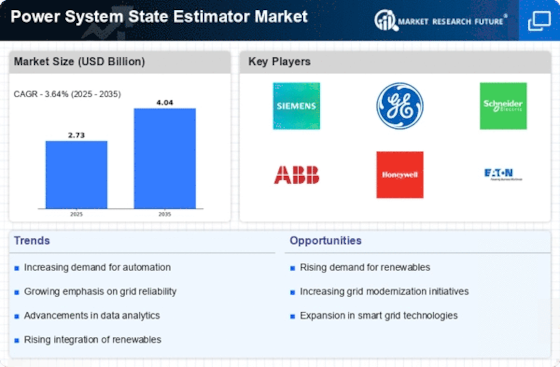

The Power System State Estimator Market is experiencing a notable shift due to the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance the accuracy and efficiency of state estimation processes, allowing for real-time monitoring and control of power systems. As utilities seek to optimize their operations, the demand for sophisticated state estimation tools is likely to increase. According to recent data, the market for AI in power systems is projected to grow at a compound annual growth rate of over 20% in the coming years. This trend suggests that the Power System State Estimator Market will continue to evolve, driven by the need for improved decision-making capabilities and operational efficiency.

Focus on Renewable Energy Integration

The transition towards renewable energy sources is a pivotal driver in the Power System State Estimator Market. As countries strive to meet sustainability goals, the integration of solar, wind, and other renewable sources into existing power grids presents unique challenges. State estimators play a crucial role in managing the variability and unpredictability associated with these energy sources. The increasing penetration of renewables is expected to boost the demand for advanced state estimation solutions, which can provide accurate real-time data for grid operators. Market analysis indicates that the share of renewables in the energy mix is anticipated to reach 50% by 2030, further underscoring the importance of robust state estimation in ensuring grid stability.

Growing Demand for Grid Modernization

The Power System State Estimator Market is significantly influenced by the growing demand for grid modernization. Aging infrastructure and the need for enhanced reliability are prompting utilities to upgrade their systems. State estimation technologies are integral to this modernization effort, providing utilities with the necessary tools to monitor and manage complex grid operations effectively. The market for grid modernization is projected to reach $100 billion by 2026, driven by investments in smart grid technologies. This trend suggests that the Power System State Estimator Market will benefit from increased funding and focus on modernizing power systems to meet future energy demands.

Regulatory Compliance and Sustainability Initiatives

Regulatory compliance is becoming increasingly stringent, compelling utilities to adopt advanced technologies in the Power System State Estimator Market. Governments and regulatory bodies are implementing policies aimed at reducing carbon emissions and enhancing grid reliability. This regulatory landscape drives utilities to invest in state estimation tools that ensure compliance with environmental standards and operational efficiency. The market is witnessing a surge in demand for solutions that not only meet regulatory requirements but also contribute to sustainability initiatives. It is estimated that investments in compliance-related technologies will exceed $10 billion by 2027, indicating a robust growth trajectory for the Power System State Estimator Market.