Poultry Vaccines Market Summary

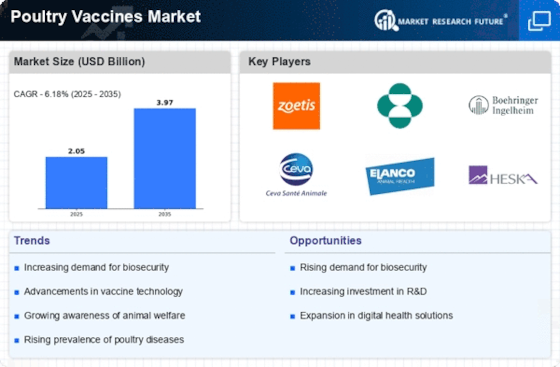

As per Market Research Future analysis, the Poultry Vaccines Market Size was estimated at 2.05 USD Billion in 2024. The Poultry Vaccines industry is projected to grow from 2.177 USD Billion in 2025 to 3.966 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.18% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Poultry Vaccines Market is poised for growth driven by technological advancements and increasing biosecurity measures.

- Technological advancements in vaccines are enhancing efficacy and safety, thereby attracting greater adoption among poultry producers.

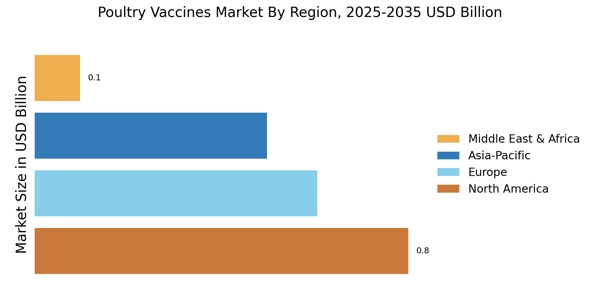

- North America remains the largest market for poultry vaccines, while the Asia-Pacific region is experiencing the fastest growth due to rising poultry production.

- Live attenuated vaccines dominate the market, whereas inactivated vaccines are emerging as the fastest-growing segment in response to evolving disease challenges.

- The rising demand for poultry products and the emergence of new poultry diseases are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 2.05 (USD Billion) |

| 2035 Market Size | 3.966 (USD Billion) |

| CAGR (2025 - 2035) | 6.18% |

Major Players

Zoetis (US), Merck Animal Health (US), Boehringer Ingelheim (DE), Ceva Santé Animale (FR), Elanco Animal Health (US), Heska Corporation (US), Vetoquinol (FR), Phibro Animal Health (US), IDT Biologika (DE)