Rising Geriatric Population

The increasing geriatric population is another significant factor influencing the Positron Emission Tomography Market PET Market. As individuals age, the prevalence of chronic diseases, including cancer and neurological disorders, tends to rise. PET imaging plays a crucial role in diagnosing and managing these conditions, making it an essential tool in geriatric healthcare. According to demographic projections, the global population aged 65 and older is expected to double by 2050, reaching approximately 1.5 billion. This demographic shift is likely to create a heightened demand for diagnostic imaging services, including PET scans, as healthcare systems adapt to the needs of an aging population. Consequently, the Positron Emission Tomography Market PET Market is poised for growth in response to these demographic changes.

Increasing Incidence of Cancer

The rising incidence of cancer worldwide is a critical driver for the Positron Emission Tomography Market PET Market. As cancer remains one of the leading causes of mortality, the demand for effective diagnostic tools is paramount. PET imaging is particularly valuable in oncology for tumor detection, staging, and monitoring treatment response. Recent statistics suggest that the number of new cancer cases is expected to reach 29.5 million by 2040, which underscores the urgent need for advanced imaging technologies. This growing patient population is likely to propel the demand for PET scans, thereby driving market growth. The Positron Emission Tomography Market PET Market is thus positioned to expand significantly as healthcare providers seek to implement more effective diagnostic strategies.

Government Initiatives and Funding

Government initiatives and funding aimed at enhancing healthcare infrastructure are pivotal drivers for the Positron Emission Tomography Market PET Market. Many countries are investing in advanced medical technologies to improve diagnostic capabilities and patient care. These investments often include funding for research and development in imaging technologies, as well as subsidies for healthcare facilities to acquire state-of-the-art equipment. For instance, various national health programs are increasingly recognizing the importance of PET imaging in early disease detection and management. This financial support is likely to stimulate market growth, as healthcare providers are more inclined to adopt PET technology. The Positron Emission Tomography Market PET Market stands to benefit significantly from these governmental efforts to bolster healthcare services.

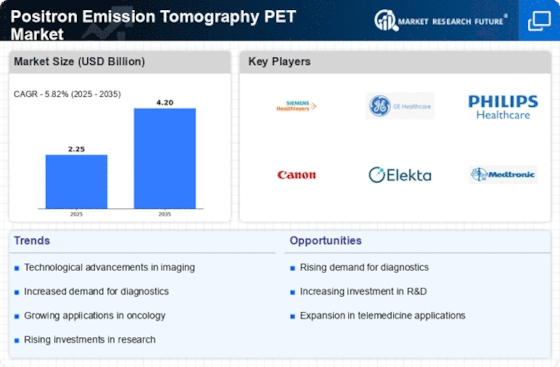

Technological Advancements in Imaging

The Positron Emission Tomography Market PET Market is experiencing a surge in technological advancements that enhance imaging capabilities. Innovations such as hybrid imaging systems, which combine PET with computed tomography (CT) or magnetic resonance imaging (MRI), are becoming increasingly prevalent. These systems provide more accurate and comprehensive diagnostic information, thereby improving patient outcomes. The integration of artificial intelligence and machine learning algorithms into PET imaging is also on the rise, facilitating faster image processing and analysis. According to recent data, the market for advanced imaging technologies is projected to grow at a compound annual growth rate of over 10% in the coming years. This trend indicates a robust demand for sophisticated imaging solutions within the Positron Emission Tomography Market PET Market.

Growing Awareness of Preventive Healthcare

The growing awareness of preventive healthcare is driving demand within the Positron Emission Tomography Market PET Market. As patients and healthcare providers increasingly prioritize early detection and prevention of diseases, the role of advanced imaging technologies becomes more pronounced. PET scans are recognized for their ability to detect abnormalities at an early stage, which can lead to more effective treatment options. Public health campaigns and educational initiatives are contributing to this heightened awareness, encouraging individuals to seek regular screenings. Market data indicates that the preventive healthcare sector is expanding rapidly, with a projected growth rate of over 8% annually. This trend suggests that the Positron Emission Tomography Market PET Market will likely see increased utilization of PET imaging as part of routine health assessments.