Government Initiatives and Funding

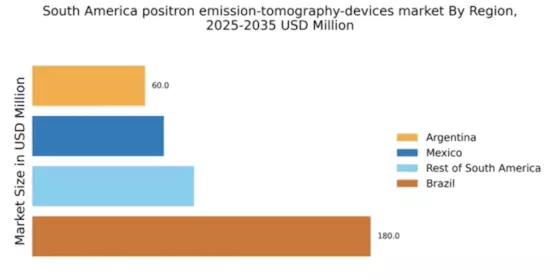

Government initiatives aimed at improving healthcare infrastructure in South America are significantly influencing the positron emission-tomography-devices market. Various countries in the region are allocating substantial budgets to enhance medical facilities and expand access to advanced diagnostic technologies. For example, Brazil's Ministry of Health has announced investments exceeding $500 million to upgrade imaging services, including positron emission tomography. Such funding not only facilitates the acquisition of state-of-the-art devices but also promotes research and development in the field. Consequently, the positron emission-tomography-devices market is poised for expansion as governments prioritize healthcare advancements and strive to meet the growing demand for sophisticated diagnostic tools.

Rising Awareness of Diagnostic Imaging

There is a notable increase in awareness regarding the importance of diagnostic imaging among healthcare professionals and patients in South America. This growing recognition is driving the positron emission-tomography-devices market, as more individuals seek advanced imaging solutions for accurate diagnosis and treatment planning. Educational campaigns and training programs are being implemented to inform stakeholders about the benefits of positron emission tomography in detecting diseases at an early stage. As a result, the market is likely to witness a surge in demand, with healthcare providers increasingly adopting these technologies to enhance patient care and improve clinical outcomes.

Increasing Prevalence of Chronic Diseases

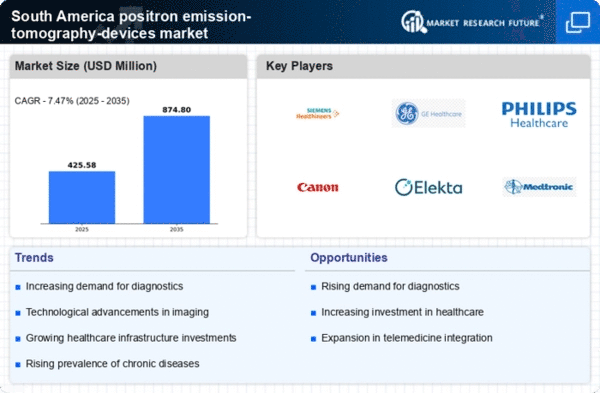

The rising incidence of chronic diseases in South America is a crucial driver for the positron emission-tomography-devices market. Conditions such as cancer, cardiovascular diseases, and neurological disorders are becoming more prevalent, necessitating advanced diagnostic tools. For instance, cancer cases in South America are projected to increase by approximately 30% by 2030, leading to a heightened demand for effective imaging technologies. Positron emission tomography devices play a vital role in the early detection and monitoring of these diseases, thereby enhancing patient outcomes. As healthcare providers seek to improve diagnostic accuracy, the positron emission-tomography-devices market is likely to experience significant growth, driven by the need for innovative solutions to address the increasing burden of chronic illnesses.

Growing Investment in Healthcare Infrastructure

The increasing investment in healthcare infrastructure across South America is a pivotal driver for the positron emission-tomography-devices market. Governments and private entities are channeling resources into building and upgrading medical facilities, which includes the procurement of advanced diagnostic equipment. Reports indicate that healthcare spending in the region is projected to grow by 5% annually, with a significant portion allocated to imaging technologies. This trend is likely to bolster the positron emission-tomography-devices market, as enhanced infrastructure will enable healthcare providers to offer better diagnostic services, ultimately improving patient access to essential imaging technologies.

Technological Innovations in Imaging Techniques

Technological innovations in imaging techniques are transforming the landscape of the positron emission-tomography-devices market. Advancements such as hybrid imaging systems, which combine positron emission tomography with computed tomography (CT), are gaining traction in South America. These innovations enhance image quality and provide comprehensive diagnostic information, thereby improving clinical decision-making. The introduction of new radiopharmaceuticals and software solutions further augments the capabilities of positron emission tomography devices. As healthcare facilities strive to adopt cutting-edge technologies, the positron emission-tomography-devices market is expected to flourish, driven by the demand for enhanced imaging solutions that facilitate accurate disease diagnosis and monitoring.