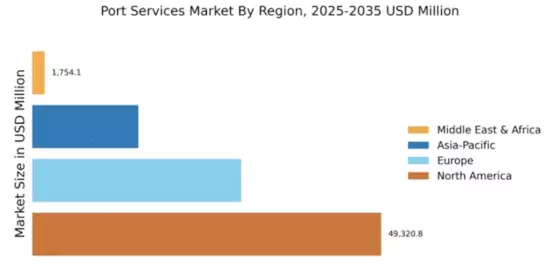

North America : Leading Global Market

North America is poised to maintain its leadership in the Port Services Market, holding a significant market share of 49320.8. The region's growth is driven by robust trade activities, advanced infrastructure, and increasing demand for efficient logistics solutions. Regulatory support, including streamlined customs processes and investment in port modernization, further catalyzes growth. The focus on sustainability and digital transformation is also shaping the future of port services in this region.

The competitive landscape in North America is characterized by major players such as A.P. Moller - Maersk and the Port of Los Angeles. The U.S. leads the market, with significant contributions from Canada and Mexico. The presence of key players enhances service offerings and fosters innovation. As trade volumes continue to rise, the region is expected to leverage its strategic geographic position to enhance its port services capabilities, ensuring continued dominance in the global market.

Europe : Strategic Trade Hub

Europe's Port Services Market, valued at 29526.4, is experiencing growth driven by strategic trade routes and regulatory frameworks aimed at enhancing port efficiency. The European Union's initiatives to promote sustainable shipping practices and reduce emissions are pivotal in shaping the market landscape. Additionally, investments in digital technologies and infrastructure improvements are expected to boost operational efficiency and service quality across the region.

Leading countries such as Germany, the Netherlands, and France are at the forefront of this market, with key players like the Port of Rotterdam Authority and Hapag-Lloyd driving innovation. The competitive environment is marked by collaboration among stakeholders to enhance service delivery and meet evolving customer demands. As Europe continues to adapt to global trade dynamics, its port services sector is set to thrive, supported by a strong regulatory framework and investment in modernization.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region, with a market size of 15000.0, is emerging as a significant player in the Port Services Market. The growth is fueled by increasing trade activities, urbanization, and the expansion of manufacturing hubs. Countries like China and India are investing heavily in port infrastructure to accommodate rising cargo volumes. Additionally, government initiatives aimed at enhancing logistics and supply chain efficiency are driving demand for port services in the region.

China stands out as a leader in the Asia-Pacific market, with major players like COSCO Shipping and Yang Ming Marine Transport Corporation leading the charge. The competitive landscape is evolving, with new entrants and collaborations enhancing service offerings. As the region continues to develop its port capabilities, it is expected to play a crucial role in global trade, leveraging its strategic location and growing economies to boost port services.

Middle East and Africa : Emerging Trade Routes

The Middle East and Africa region, with a market size of 1754.13, presents unique growth opportunities in the Port Services Market. The region is strategically positioned as a transit hub for global trade, with increasing investments in port infrastructure and logistics. Government initiatives aimed at diversifying economies and enhancing trade facilitation are driving demand for port services. The focus on developing smart ports and improving operational efficiencies is also gaining traction.

Countries like the UAE and South Africa are leading the way in port services, with significant investments from both public and private sectors. The competitive landscape is characterized by a mix of established players and emerging companies, all vying to enhance service delivery. As the region capitalizes on its strategic location and growing trade volumes, the port services sector is expected to witness substantial growth in the coming years.