Top Industry Leaders in the Polyvinyl Chloride Market

Polyvinyl Chloride Market Strategies for Success:

-

Product Differentiation: Manufacturers are moving beyond the basic PVC resin, developing specialty grades with enhanced properties like fire resistance, UV protection, and improved flexibility. This caters to specific needs in diverse industries, like automotive and healthcare. -

Vertical Integration: Leading players are integrating upstream and downstream, securing raw materials and controlling distribution channels. This enhances cost control, supply chain efficiency, and customer responsiveness. -

Sustainability Focus: Environmental concerns are driving innovation in sustainable PVC production using recycled materials and renewable energy sources. This caters to growing consumer demand for eco-friendly products and opens up new market opportunities. -

Regional Expansion: Emerging markets in Asia-Pacific, particularly China and India, offer significant growth potential. Players are establishing production facilities and distribution networks in these regions to tap into the rising demand. -

Technological Advancements: Automation and digitalization are transforming the PVC industry. Advanced manufacturing processes, data analytics, and AI-powered optimization are improving efficiency, reducing waste, and boosting productivity.

Factors Shaping Market Share:

-

Raw Material Prices: Fluctuations in the price of chlorine and vinyl chloride monomer (VCM), the key raw materials for PVC, significantly impact production costs and profitability. -

Regional Demand Dynamics: The construction and infrastructure boom in developing economies is driving PVC demand, while mature markets face slower growth. -

Regulations and Environmental Concerns: Stringent environmental regulations and evolving consumer preferences towards sustainable alternatives can pose challenges for the PVC industry. -

Competition from Alternative Materials: The rise of bioplastics and other sustainable materials is putting pressure on PVC manufacturers to innovate and improve their environmental footprint.

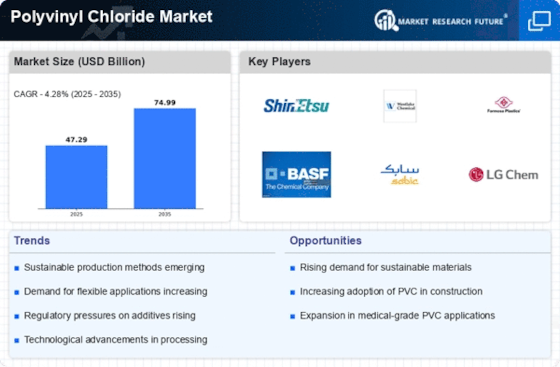

Key Companies in the Polyvinyl Chloride market include

- Westlake Chemical Corporation

- Ineos

- DCW Ltd

- Formosa Plastics Corporation

- Xinjiang Zhongtai Chemical Co. Ltd

- LG Chem

- Orbia

- SABIC

- Tianye Group

- Occidental Petroleum Corporation

Recent Developments:

In boosting Shintech Inc.’s capacity, its US subsidiary, Shin-Etsu Chemical Co. Ltd, announced a capital investment of USD 1.25 billion in January 2021 towards strengthening its integrated PVC business, which is owned by Shin-Etsu Chemical Co., Ltd. The annual PVC production capacity of Shintech is expected to reach 3.62 million metric tons.

Concerning Orbia’s PVC Unit, they were contemplating selling it on the basis of demand constraints, though they have not officially made their stand known.

INEOS Group Ltd announced that beginning October 2022, it will produce recycled raw materials from plastic waste amounting to 100,000 tonnes annually, aiming to create a circular economy for key plastic items.

KEM ONE entered into an agreement with Polyloop in July 2020 to develop new recycling solutions for PVC.

November 2022 DCW Ltd. expanded its Chlorinated Polyvinyl Chloride (CPVC) and Synthetic Iron Oxide Pigment (SIOP) capacity by investing $16 million.

October 2022, TotalEnergies and Valeo have announced an agreement to develop an innovative method for cooling electric vehicle batteries using a new high-performance dielectric liquid. This innovation not only improves the use of electric vehicles, but also reduces the carbon footprint.

August 2022 Continental is to use BIOVYN, bio-attributed PVC, from INOVYN to produce its technical and decorative surface materials for its automotive customers. The agreement will help to reduce its carbon footprint and meet customer demand for sustainable bio-based products.

January 2021: Orbia planned to sell its PVC Unit due to demand constraints. However, the final decision on the divestment is yet to be officially revealed.

In October 2020, Xinjiang Zhongtai Chemical Fukang Energy Company's AGR resin passed the National Standard Project Evaluation; low impact strength is one limitation of commodity polyvinyl chloride resin, so specialized anti-scour polyvinyl chloride resin AGR resin belongs to this category; modified vinyl chloride resin is also embodied.