North America : Market Leader in Polyurethane Wheels

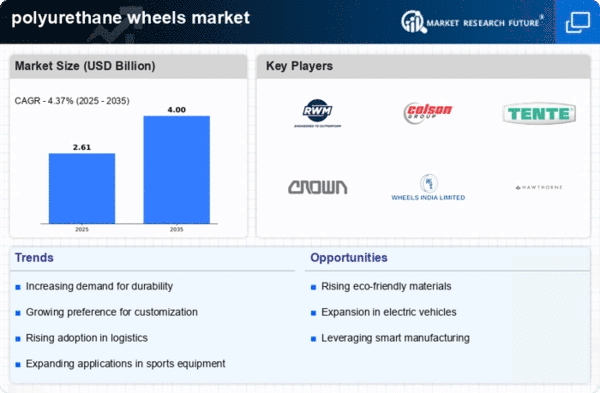

North America is poised to maintain its leadership in the polyurethane wheels market, holding a market share of 1.0 in 2025. The region's growth is driven by increasing demand from various sectors, including logistics and manufacturing, where durability and performance are paramount. Regulatory support for sustainable materials further enhances market prospects, encouraging innovation and investment in advanced manufacturing techniques. The competitive landscape is characterized by key players such as RWM, Crown Wheels, and Hawthorne, who are leveraging technological advancements to enhance product offerings. The U.S. stands out as the leading country, with a robust infrastructure and a focus on quality. The presence of established companies fosters a dynamic market environment, ensuring continuous growth and adaptation to consumer needs.

Europe : Emerging Market with Growth Potential

Europe is witnessing a significant rise in the polyurethane wheels market, with a market size of 0.75 in 2025. The growth is fueled by increasing industrial activities and a shift towards lightweight, durable materials. Regulatory frameworks promoting eco-friendly products are also pivotal, as they encourage manufacturers to innovate and comply with sustainability standards, thus driving demand. Leading countries in this region include Germany, the UK, and France, where companies like Tente International and Colson Group are prominent. The competitive landscape is evolving, with a focus on enhancing product performance and sustainability. The presence of established manufacturers and a growing emphasis on research and development are key factors contributing to the region's market dynamics.

Asia-Pacific : Rapid Growth in Emerging Markets

Asia-Pacific is emerging as a significant player in the polyurethane wheels market, with a market size of 0.6 in 2025. The region's growth is driven by rapid industrialization, urbanization, and increasing demand for efficient logistics solutions. Countries are investing in infrastructure development, which is expected to further boost the market. Regulatory initiatives aimed at enhancing product quality and safety are also contributing to market expansion. India and China are leading the charge, with companies like Wheels India Limited making substantial contributions. The competitive landscape is marked by a mix of local and international players, fostering innovation and competitive pricing. As the region continues to develop, the demand for high-quality polyurethane wheels is expected to rise significantly, driven by both industrial and consumer needs.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa region is gradually emerging in the polyurethane wheels market, with a market size of 0.15 in 2025. The growth is primarily driven by increasing industrial activities and a rising demand for durable materials in various sectors. However, the market remains relatively untapped, presenting significant opportunities for growth. Regulatory frameworks are evolving, aiming to enhance product standards and safety, which will likely stimulate market development. Countries like South Africa and the UAE are at the forefront, with a growing number of local manufacturers entering the market. The competitive landscape is still developing, with opportunities for both established and new players to capture market share. As infrastructure projects expand, the demand for polyurethane wheels is expected to increase, paving the way for future growth.