Aircraft Wheels and Brakes Industry

The research methodology used in this project follows an iterative approach. Through analysis of primary and secondary data, the report is structured to explain the dynamics of the Aircraft Wheels and Brakes industry. The different approaches such as the Bottom-Up Approach, the Top-Down Approach, the Factor Analysis, the Time-Series Analysis, and the Demand Side and Supply Side Data Triangulation used to verify different data sources and further in-depth insights into the market.

1. Research Objectives

The primary aim of the research is to understand the market dynamics of the Aircraft Wheels and Brakes industry. The research objectives for this project are:

- To identify key trends in the Aircraft Wheels and Brakes market

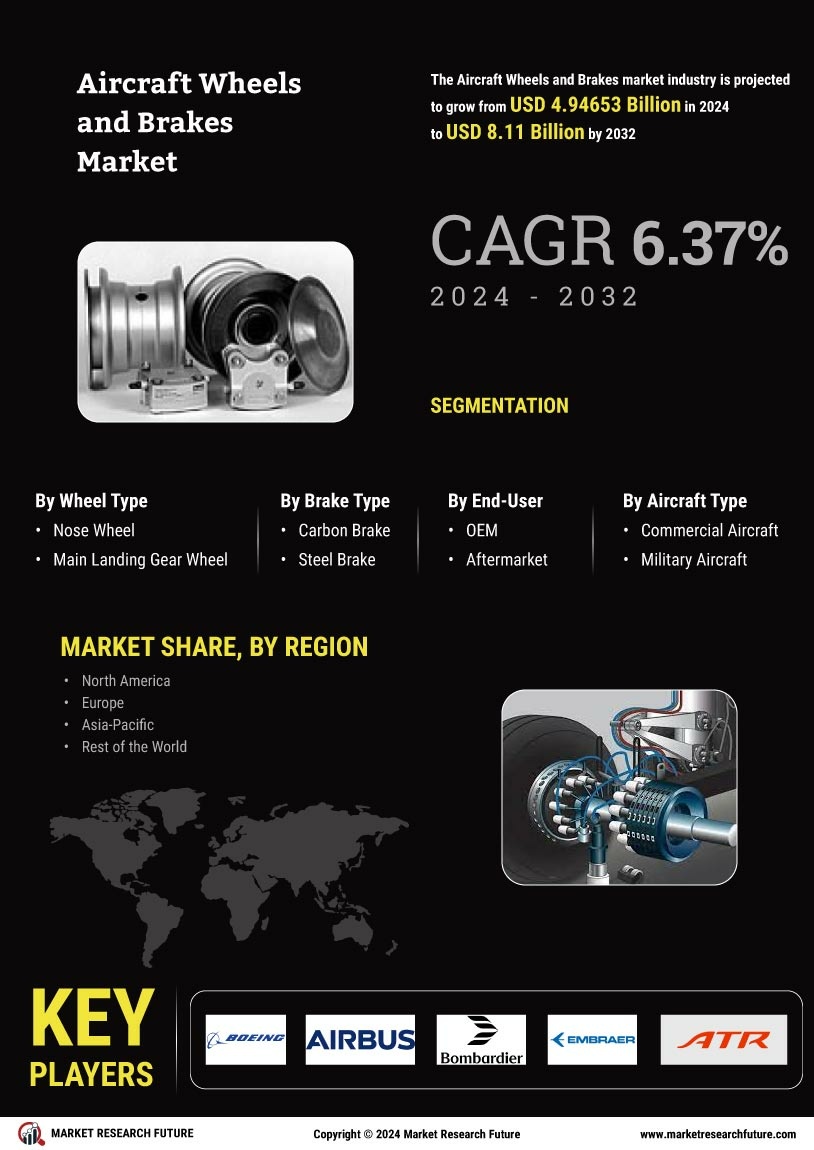

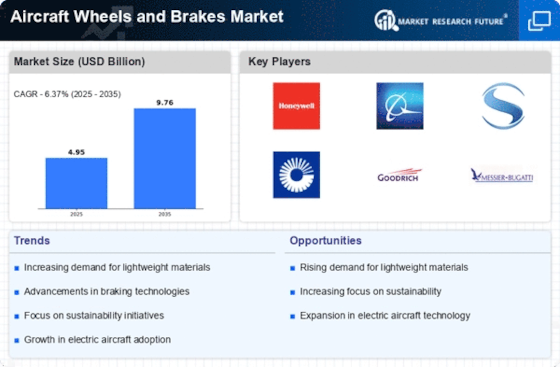

- To study the current market size and forecast future growth potential

- To analyze industry dynamics such as drivers, restraints, and opportunities

- To assess the competitive landscape and identify key competitors

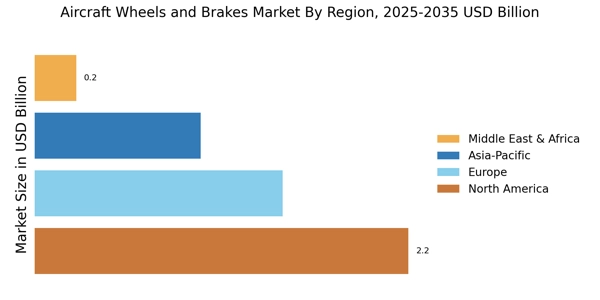

- To understand the regional trends in the Aircraft Wheels and Brakes industry

2. Research Methodology

The project follows an iterative and sequential approach to satisfy the research objectives. The major stages involved are:

- Secondary Research: The first stage includes a comprehensive review of current market insights related to the Aircraft Wheels and Brakes industry. The secondary data review entails the review of industry standards, frameworks, and market reports published by credible sources. It includes the study of published articles, press releases, and research papers. The secondary data gathered is used to formulate the primary interviews and to determine the research scope.

- Primary Research: The second stage of the research includes primary interviews with prominent industry experts. The aim is to validate the secondary data gathered, identify the key industry dynamics, and gain fresh insights. The primary information is gathered through a series of online and offline surveys, in-depth interviews, and customer panels.

- Approaches Used: The project report makes use of various approaches to verify different data sources and further in-depth insights into the market. These tools used include:

- Bottom-up Approach: The bottom-up approach is used to estimate the global market size based on regional trends. This comprises the forecast of individual sub-segments including revenue generated by each sub-segment.

- Top-Down Approach: The top-down approach is used to validate the figures generated through the bottom-up approach. The data estimated through the top-down approach is compared with the bottom-up approach to gain consistent and reliable results of the market size estimation.

- Factor Analysis: Factor analysis is used to determine the market drivers and restraints based on the key influencing factors.

- Time-Series Analysis: Time-series analysis is used to forecast the market size based on the forecasted key influencing factors.

- Demand Side and Supply Side Data Triangulation: The demand side and supply side data triangulation is used to identify the gap between primary and secondary research and to validate the market size estimation by other players.

3. Research Assumptions

The research project follows certain assumptions to facilitate the estimation of the Aircraft Wheels and Brakes market.

- This report considers the changes in macro-economic factors such as Gross Domestic Product into account.

- The data collected through secondary and primary research is used as a basis for quantitative and qualitative analysis.

- The population covered is the entire global population and not the population of any particular region.

- This report considers the production and demand rate of the Aircraft Wheels and Brakes industry during the forecast period 2023 to 2030.

- The market size is estimated based on the existing database and forecasts from the leading research agencies.

4. Data Collection & Validation

The data collected both through primary and secondary sources is gathered and analyzed to arrive at an accurate market size estimation for the Aircraft Wheels and Brakes industry. The various tools used in the research project help in collecting reliable and valid data.

- Secondary Data Collection: The secondary data collection has been done from credible sources such as annual reports, websites of industry associations such as the Air Transport Association of Canada, blogs of industry experts, and publications of market research firms such as Markets and Markets, and Grand View Research.

- Primary Research: Primary research aids in gaining an in-depth understanding of the market drivers and restraints. The primary data is collected through a series of online and offline surveys, customer panels, and in-depth interviews with industry experts.

5. Market Estimation

The global market size is estimated using the Bottom-up Approach. The methodology used for forecasting the trends is Time-Series Analysis. The major factors influencing the future growth of the industry are technological advancements, changing regulations, new product launches, increasing penetration of technology, and improving infrastructure. The primary research is used to validate the data gathered from secondary sources.