Research Methodology on Polyurethane Dispersion Market

Introduction

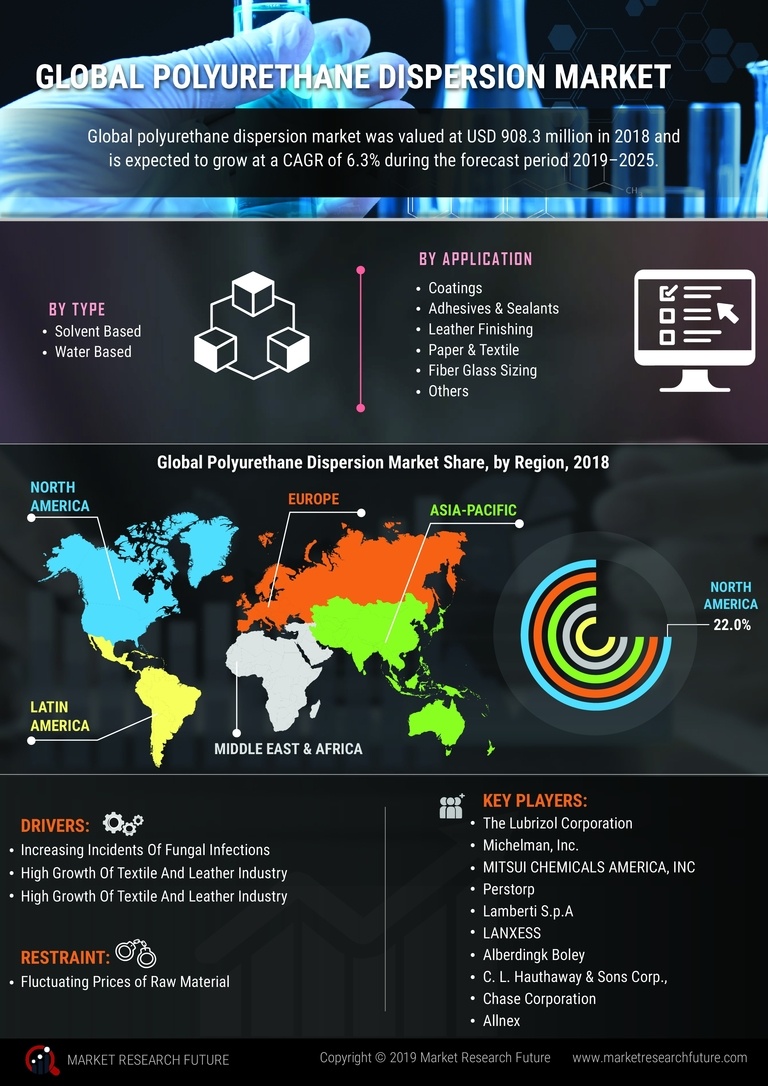

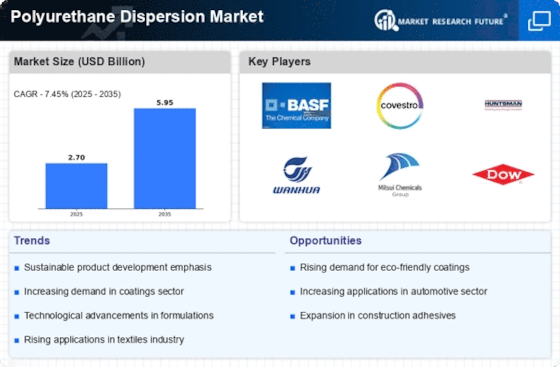

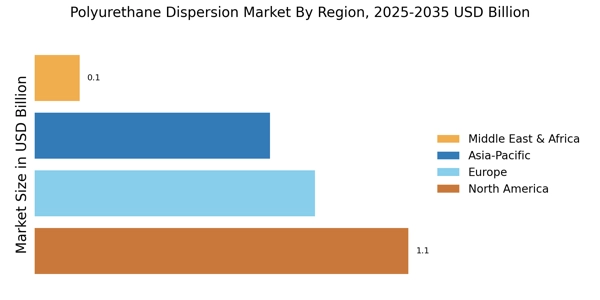

Research is the process of finding answers to a set of questions or a problem statement. It is a systematic and organized process that is instrumental in providing insight into important matters and phenomena. Research is the foundation of knowledge, in the context of the economy, it is the engine of progress that enables the growth and development of economies. The purpose of this research methodology is to provide the outline and the framework that allows conducting research objectively and effectively to gain in-depth knowledge and understanding of the polyurethane dispersion market, analyze the competitive landscape of the polyurethane dispersion market including the major players, identify and analyze the key drivers and restraints that are impacting the polyurethane dispersion market, and propose strategies to capture market share.

Research Objective

The primary objective of this research is to gain an in-depth understanding of the polyurethane dispersion market, analyze the competitive landscape of the polyurethane dispersion market including the major players and the major drivers and restraints of the polyurethane dispersion market, and propose strategies in order to capture market share.

Research Scope

This research focuses on the global polyurethane dispersion market, with a detailed and comprehensive analysis of the market structure and the competitive landscape, including the major players and their strategies. It also analyzes the drivers, restraints and opportunities of the polyurethane dispersion market, and proposes strategies to capture market share.

Research Methodology

The research methodology used in this research is both qualitative and quantitative. The qualitative research is focused on the desk research method, gathering information from official websites, news and blogs, industry reports, and other related sources. The quantitative research focuses on the survey method, where a structured questionnaire is developed in order to establish structured data points. The data points are used to identify the current status of the polyurethane dispersion market, analyze its major players, the key drivers and restraints that are impacting the polyurethane dispersion market, and propose strategies in order to capture market share.

The survey is distributed to relevant stakeholders and industry experts. The participants of the survey include the key players in the industry, experts, and stakeholders involved in the polyurethane dispersion market. The surveys are electronically distributed in the form of online survey forms, as well as in the form of an online discussion board in order to elicit qualitative feedback from the respondents.

The data gathered from the survey and discussions is modelled using SPSS to make sense of the data and draw inferences and conclusions. The qualitative data is analyzed using interpretative discourse analysis to make sense of the qualitative data and draw inferences.

Data Collection

In order to collect the data required for this research, both primary and secondary data sources are used. The primary data sources include the surveys conducted with key stakeholders, industry experts and other relevant stakeholders. The secondary data sources include official websites, news and blogs, industry reports, and other related sources.

Research Process

The research process consists of the following steps:

- Identification of research goals and objectives

- Developing the research design

- Gathering the data

- Analyzing the data

- Developing the research report

Conclusion

This research methodology outlines the overall framework and outline of the research process for the polyurethane dispersion market. The research design includes the qualitative and quantitative research methods that are used to collect and analyze the data from the relevant stakeholders. The research process includes the steps of identification of research goals and objectives, developing the research design, gathering the data, analyzing the data, and finally developing the research report. The research is expected to provide insights into the polyurethane dispersion market and the competitive landscape, analyze the key drivers and restraints that are influencing the polyurethane dispersion market and propose strategies in order to capture market share.