Market Trends

Key Emerging Trends in the Polyphenylene Oxide Market

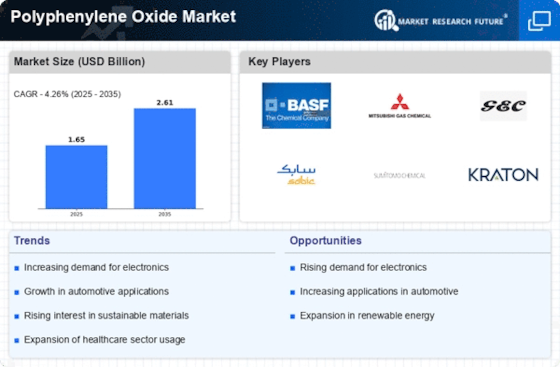

The Polyphenylene Oxide (PPO) Market is influenced by several market trends that shape its dynamics and growth trajectory:

Increasing Demand from Automotive Sector: One prominent trend in the PPO market is the growing demand from the automotive sector. PPO, known for its high heat resistance, dimensional stability, and mechanical strength, is widely used in automotive components such as electrical connectors, under-the-hood parts, and interior trim. The trend towards lightweighting in automotive design further boosts the demand for PPO, as it helps improve fuel efficiency without compromising on performance or safety.

Rising Adoption in Electronics and Electrical Applications: Another significant trend driving the PPO market is its increasing adoption in electronics and electrical applications. PPO's excellent electrical properties, including high dielectric strength and low moisture absorption, make it ideal for manufacturing electronic components such as connectors, switches, and housings. With the growing demand for consumer electronics, telecommunications equipment, and electrical appliances, the demand for PPO is expected to continue rising in this sector.

Focus on Sustainable Materials: Sustainability is emerging as a key trend in the PPO market, driven by growing environmental concerns and regulatory pressure. Manufacturers are increasingly focusing on developing sustainable PPO formulations by incorporating recycled content or bio-based materials. Additionally, there is a trend towards recyclability and circularity, with efforts to improve the recyclability of PPO-based products and promote closed-loop systems.

Innovations in Material Properties: Continuous innovation in material properties is another notable trend in the PPO market. Manufacturers are investing in research and development to enhance the performance characteristics of PPO, such as improving flame retardancy, chemical resistance, and surface aesthetics. These innovations enable PPO to meet the evolving needs of various end-use industries and expand its application scope.

Growing Demand in Healthcare Sector: The healthcare sector represents a growing market for PPO, driven by its biocompatibility, sterilizability, and resistance to chemicals and solvents. PPO is used in medical device applications such as housings for diagnostic equipment, surgical instruments, and fluid handling systems. With increasing healthcare expenditure and demand for advanced medical devices, the demand for PPO in this sector is expected to grow steadily.

Shift towards High-Performance Polymers: There is a noticeable trend towards the adoption of high-performance polymers like PPO in various industrial applications. PPO offers a unique combination of properties, including high heat resistance, mechanical strength, and dimensional stability, making it suitable for demanding applications in aerospace, defense, and industrial machinery. The shift towards high-performance polymers is driven by the need for lightweight, durable, and cost-effective materials in these industries.

Regional Market Dynamics: Market trends in the PPO market are also influenced by regional dynamics, including factors such as economic growth, industrial development, and regulatory environment. Emerging economies, particularly in Asia-Pacific, are experiencing rapid industrialization and urbanization, driving demand for PPO in construction, automotive, and electronics sectors. In contrast, mature markets in North America and Europe focus on sustainability, innovation, and niche applications of PPO.

Supply Chain Disruptions and Resilience: Like many other industries, the PPO market is susceptible to supply chain disruptions, which can impact raw material availability, production capacity, and distribution channels. Manufacturers are increasingly focusing on building resilient supply chains, diversifying sourcing strategies, and implementing risk mitigation measures to navigate uncertainties and ensure continuity of operations.

Digitalization and Industry 4.0: Digitalization and the adoption of Industry 4.0 technologies are influencing market trends in the PPO industry. Manufacturers are leveraging technologies such as artificial intelligence, predictive analytics, and IoT-enabled sensors to optimize production processes, improve product quality, and enhance supply chain visibility. These digital initiatives enable companies to achieve operational efficiency, agility, and competitiveness in the market.

Collaborative Partnerships and Strategic Alliances: Collaboration and strategic alliances between industry players are becoming increasingly prevalent as a trend in the PPO market. Companies are forming partnerships to share resources, expertise, and technologies, accelerate innovation, and access new markets. Collaborative efforts enable participants to leverage synergies, mitigate risks, and capitalize on emerging opportunities in the dynamic PPO market landscape.

Leave a Comment