-

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

-

Market Structure

-

Market Research Methodology

-

Research Process

-

Secondary Research

-

Primary Research

-

Forecast Model

-

Market Landscape

-

Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Threat of Substitutes

- Segment Rivalry

-

Value Chain/Supply Chain of Global Polyphenylene Ether Market

-

Industry Overview of Global Polyphenylene Ether Market

-

Introduction

-

Growth Drivers

-

Impact Analysis

-

Market Challenges

-

Market Trends

-

Introduction

-

Growth Trends

-

Impact Analysis

-

Polyphenylene Ether PPE Market, by Type

-

Introduction

-

PPE/PA (polyamide)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Region, 2020–2027

-

PPE/PP (polypropylene)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Region, 2020–2027

-

PPE/PS (polystyrene)

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Region, 2020–2027

-

Others

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Region, 2020–2027

-

Polyphenylene Ether PPE Market, by Application

-

Introduction

-

Automotive

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Region, 2020–2027

-

Electrical and electronics

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Region, 2020–2027

-

Healthcare

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Region, 2020–2027

-

Aerospace

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Region, 2020–2027

-

Others

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Region, 2020–2027

-

Polyphenylene Ether PPE Market, by Region

-

Introduction

-

North America

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Type, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Application, 2020–2027

- US

- Canada

-

Europe

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Type, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Application, 2020–2027

- Germany

- France

- Italy

- Spain

- UK

- Russia

- Poland

-

Asia-Pacific

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Type, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Application, 2020–2027

- China

- India

- Japan

- Australia

- New Zealand

- Rest of Asia-Pacific

-

Middle East & Africa

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Type, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Application, 2020–2027

- Turkey

- Israel

- North Africa

- GCC

- Rest of the Middle East & Africa

-

Latin America

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Type, 2020–2027

- Market Estimates & Polyphenylene Ether PPE Market, by Application, 2020–2027

- Brazil

- Argentina

- Mexico

- Rest of Latin America

-

Company Landscape

-

Company Profiles

-

Asahi Kasei Corporation

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

BASF SE

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Evonik Industries AG

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Entec Polymers

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

LyondellBasell Industries Holdings B.V.

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Mitsubishi Chemical Corporation

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Oxford Polymers

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Polyplastics Co. Ltd

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

SABIC

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Sumitomo Chemical Co., Ltd.

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Ashley Polymers, Inc

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Bluestar New Chemical Materials Co., Ltd

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Nagase America Corporation

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Conclusion

-

LIST OF TABLES

-

World Population in Major Regions (2020–2030)

-

Polyphenylene Ether PPE Market, by Region, 2020–2027

-

North America: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Europe: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Asia-Pacific: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Middle East & Africa: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Latin America: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Polyphenylene Ether PPE Market, by Region, 2020–2027

-

North America: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Europe: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Table11 Asia-Pacific: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Table13 Middle East & Africa: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Table12 Latin America: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Table14 North America: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Table13 Europe: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Table14 Asia-Pacific: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Table16 Middle East & Africa: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Table15 Latin America: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Polyphenylene Ether PPE Market, by Region, 2020–2027

-

Polyphenylene Ether PPE Market, by Region, 2020–2027

-

Table25 North America: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Table26 North America: Polyphenylene Ether PPE Market, by Type, 2020–2027

-

Table27 North America: Polyphenylene Ether PPE Market, by Application, 2020–2027

-

Table28 Europe: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Table29 Europe: Polyphenylene Ether PPE Market, by Type, 2020–2027

-

Table30 Europe: Polyphenylene Ether PPE Market, by Application, 2020–2027

-

Table31 Asia-Pacific: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Table32 Asia-Pacific: Polyphenylene Ether PPE Market, by Type, 2020–2027

-

Table33 Asia-Pacific: Polyphenylene Ether PPE Market, by Application, 2020–2027

-

Table36 Middle East & Africa: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Table37 Middle East & Polyphenylene Ether PPE Market, by Type, 2020–2027

-

Table33 Middle East & Africa: Polyphenylene Ether PPE Market, by Application, 2020–2027

-

Table34 Latin America: Polyphenylene Ether PPE Market, by Country, 2020–2027

-

Polyphenylene Ether PPE Market, by Type, 2020–2027

-

Table33 Latin America: Polyphenylene Ether PPE Market, by Application, 2020–2027

-

LIST OF FIGURES

-

Global Polyphenylene Ether Market Segmentation

-

Forecast Methodology

-

Five Forces Analysis of Global Polyphenylene Ether Market

-

Value Chain of Global Polyphenylene Ether Market

-

Polyphenylene Ether PPE Market, by Country (%)

-

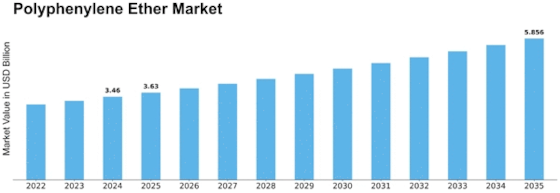

Global Polyphenylene Ether Market, 2020–2027,

-

Sub-Segments of Type, 2020

-

Polyphenylene Ether PPE Market, by Type, 2020

-

Polyphenylene Ether PPE Market, by Type, 2020–2027

-

Sub-Segments of Application

-

Polyphenylene Ether PPE Market, by Application, 2020

-

Polyphenylene Ether PPE Market, by Application, 2020–2027

Leave a Comment