Growth in Packaging Applications

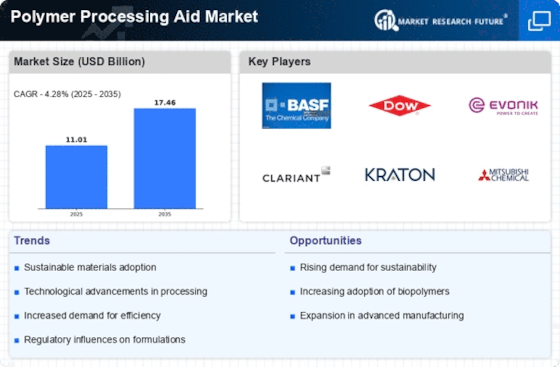

The Polymer Processing Aid Market is significantly influenced by the expanding packaging sector, which is increasingly adopting polymer-based materials. The demand for flexible and durable packaging solutions is on the rise, driven by changing consumer preferences and the need for efficient supply chain management. Polymer processing aids play a crucial role in enhancing the processing characteristics of packaging materials, allowing for better performance and functionality. Recent statistics indicate that the packaging industry is expected to grow at a compound annual growth rate of over 4% in the coming years. This growth is likely to create new opportunities for the Polymer Processing Aid Market, as manufacturers seek to innovate and improve the quality of their packaging solutions.

Regulatory Compliance and Standards

The Polymer Processing Aid Market is significantly impacted by the increasing emphasis on regulatory compliance and industry standards. As environmental concerns grow, manufacturers are compelled to adhere to stringent regulations regarding the use of additives and materials in their products. This has led to a heightened focus on the development of eco-friendly polymer processing aids that meet these regulatory requirements. Companies are investing in research and development to create compliant solutions that do not compromise on performance. The market data suggests that the demand for sustainable processing aids is likely to rise, as industries strive to align with global sustainability goals. This trend presents both challenges and opportunities for the Polymer Processing Aid Market, as it navigates the complexities of compliance while fostering innovation.

Rising Demand for Lightweight Materials

The Polymer Processing Aid Market is experiencing a notable increase in demand for lightweight materials across various sectors, including automotive and aerospace. This trend is driven by the need for improved fuel efficiency and reduced emissions. As manufacturers seek to enhance the performance of their products, the incorporation of polymer processing aids becomes essential. These aids facilitate the processing of lightweight polymers, ensuring optimal flow and reducing defects during manufacturing. According to recent data, the automotive sector alone is projected to witness a significant growth rate, with lightweight materials expected to account for a substantial share of the market. This shift towards lightweight solutions is likely to propel the Polymer Processing Aid Market further, as companies strive to meet regulatory standards and consumer preferences for sustainable products.

Technological Innovations in Polymer Processing

Technological advancements are reshaping the Polymer Processing Aid Market, as new processing techniques and formulations emerge. Innovations such as advanced compounding methods and the development of high-performance additives are enhancing the efficiency and effectiveness of polymer processing aids. These innovations not only improve the processing of polymers but also contribute to the overall quality of the final products. The introduction of smart polymers and bio-based processing aids is also gaining traction, reflecting a shift towards more sustainable practices. As manufacturers increasingly adopt these technologies, the Polymer Processing Aid Market is likely to witness a surge in demand for innovative solutions that meet the evolving needs of various applications.

Increasing Adoption of Advanced Manufacturing Techniques

The Polymer Processing Aid Market is witnessing a shift towards advanced manufacturing techniques, such as additive manufacturing and injection molding. These techniques require specific processing aids to optimize the performance of polymers during production. The growing adoption of these methods is driven by the need for precision, efficiency, and customization in manufacturing processes. As industries seek to enhance their production capabilities, the demand for specialized polymer processing aids is expected to rise. Market analysis indicates that the injection molding segment is particularly poised for growth, with a projected increase in demand for processing aids that improve flow and reduce cycle times. This trend is likely to bolster the Polymer Processing Aid Market, as manufacturers adapt to the evolving landscape of advanced manufacturing.