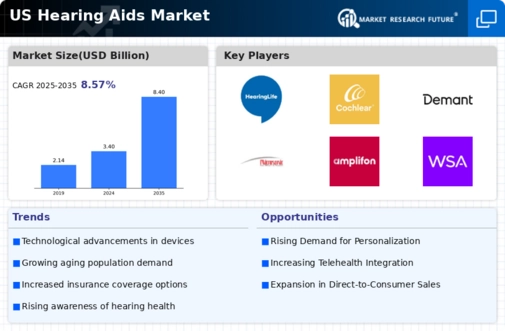

The hearing aid market in the US exhibits a dynamic competitive landscape characterized by rapid technological advancements and evolving consumer preferences. Key growth drivers include an aging population, increased awareness of hearing health, and advancements in digital technology. Major players such as Sonova Holding AG (CH), Demant A/S (DK), and Eargo, Inc. (US) are strategically positioned to leverage these trends. Sonova focuses on innovation through its extensive R&D investments, while Demant emphasizes partnerships to enhance its product offerings. Eargo, on the other hand, is carving a niche with its direct-to-consumer model, which appears to resonate well with younger demographics seeking convenience and accessibility. Collectively, these strategies shape a competitive environment that is increasingly focused on technological differentiation and consumer-centric solutions.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness to market demands. The competitive structure of the market is moderately fragmented, with several players vying for market share. However, the influence of key players is substantial, as they set benchmarks for innovation and customer service, thereby driving overall market growth.

In December 2025, Sonova Holding AG (CH) announced the launch of its latest hearing aid model, which integrates advanced AI capabilities for personalized sound processing. This strategic move is significant as it positions Sonova at the forefront of technological innovation, potentially attracting tech-savvy consumers who prioritize smart features in their hearing aids. The introduction of AI-driven solutions may also enhance user experience, thereby fostering brand loyalty.

In November 2025, Demant A/S (DK) entered a strategic partnership with a leading telehealth provider to offer remote audiology services. This collaboration is likely to expand Demant's reach and improve accessibility for consumers, particularly in underserved areas. By integrating telehealth into its service model, Demant not only enhances its value proposition but also aligns with the growing trend of digital health solutions, which could redefine patient engagement in the hearing aid sector.

In October 2025, Eargo, Inc. (US) secured a $50M investment to further develop its innovative hearing aid technology. This funding is crucial for Eargo as it seeks to enhance its product line and expand its market presence. The investment underscores the confidence investors have in Eargo's direct-to-consumer approach, which may disrupt traditional distribution channels and appeal to a broader audience.

As of January 2026, current trends in the hearing aid market include a pronounced shift towards digitalization, sustainability, and AI integration. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to pool resources and expertise. Looking ahead, competitive differentiation is expected to evolve, with a greater emphasis on innovation and technology rather than price-based competition. Companies that can reliably integrate advanced technologies into their offerings while ensuring supply chain resilience are likely to emerge as leaders in this rapidly changing market.