Market Share

Polycaprolactone Market Share Analysis

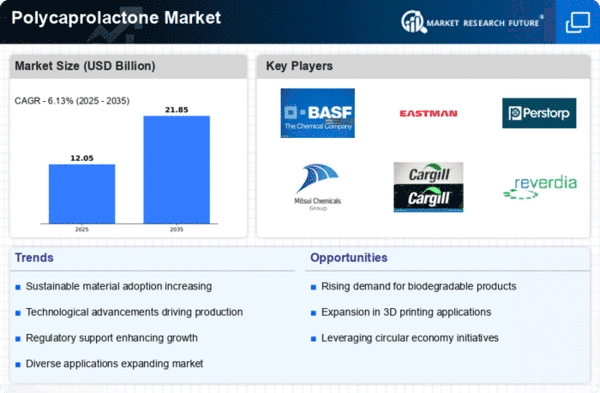

The Polycaprolactone (PCL) market is on the move. The competitive nature of this market forces companies to devise different methods of increasing their market share. Some firms focus on product differentiation, where they provide unique PCL products that suit specific consumers' needs and preferences. Through research and development, firms can develop distinct products with improved characteristics, performance, and applications, hence creating a niche for themselves in the market. A company may also adopt a low-cost strategy in the polycaprolactone industry, aiming to become the lowest-cost producer of PCL and thus gain a price edge over its rivals. These companies can offer affordable prices to customers by optimizing production processes, streamlining supply chains, and taking advantage of economies of scale. Cost leadership works best in industries where buyers are more sensitive to prices than other qualities. Market segmentation is an important tool for positioning within the Polycaprolactone market. Through the identification of distinct market segments having different requirements, companies can design products that cater to them specifically. This selective approach allows businesses to enter into niches and become leaders in particular submarkets, thereby raising their overall market shares. For instance, some applications of PCL in healthcare may have different demands compared to those used in packaging; hence, recognizing and serving these targeted needs enables companies to position themselves strategically. Collaboration is also an important aspect when it comes to determining how a firm will be positioned vis-à-vis its competitors within the Polycaprolactone sector. Such collaborations would enable firms to access complementary technologies, expertise, or resources through an alliance with other businesses or even research institutions and stakeholders within an industry event around which strategic partnerships might occur among otherwise unrelated organizations. Hence, collaboration often leads to innovative new products, improvements in the manufacturing process, and even wider distribution channels. Further, geographic expansion still plays a significant role in achieving a high position within the polycaprolactone industry. Companies that intend to increase their market share often consider new countries or regions. This background information can be used by businesses seeking to tailor their strategies according to the specific context of a particular region, which includes local market dynamics, consumer preferences, and regulations. Through such initiatives, companies can acquire new customers, get more earnings from other markets, and thus have a stronghold in the industry.

Leave a Comment