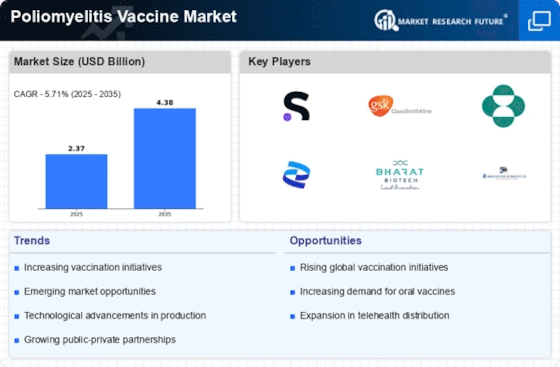

Government Initiatives and Funding

Government initiatives aimed at eradicating poliomyelitis are pivotal in shaping the Poliomyelitis Vaccine Market. Various countries have implemented national immunization programs, supported by substantial funding from both governmental and non-governmental organizations. For instance, the Global Polio Eradication Initiative has mobilized billions of dollars to support vaccination campaigns. In 2023, funding allocations for vaccine procurement and distribution have seen a marked increase, reflecting a commitment to achieving polio-free status. This financial backing not only facilitates the availability of vaccines but also enhances public awareness and participation in vaccination programs, thereby driving market growth.

Rising Incidence of Poliomyelitis Cases

The resurgence of poliomyelitis cases in certain regions appears to be a critical driver for the Poliomyelitis Vaccine Market. Reports indicate that despite significant progress in eradication efforts, sporadic outbreaks continue to occur, particularly in areas with low vaccination coverage. This situation underscores the necessity for robust vaccination programs and the development of new vaccines. The World Health Organization has noted that in 2023, there were over 1,000 reported cases in specific countries, highlighting the urgent need for effective immunization strategies. Consequently, the demand for poliomyelitis vaccines is likely to increase as health authorities strive to contain outbreaks and protect vulnerable populations.

Increased Public Awareness and Education

Increased public awareness and education regarding the importance of vaccination are crucial drivers for the Poliomyelitis Vaccine Market. Campaigns aimed at educating communities about the risks associated with poliomyelitis and the benefits of vaccination have gained momentum. In 2023, various health organizations reported a rise in public engagement, with more individuals seeking information about vaccination schedules and safety. This heightened awareness is likely to lead to increased vaccination rates, thereby driving demand for poliomyelitis vaccines. As communities become more informed, the likelihood of achieving herd immunity increases, further supporting market growth.

Collaboration Between Public and Private Sectors

Collaboration between public and private sectors is emerging as a significant driver for the Poliomyelitis Vaccine Market. Partnerships between governments, international organizations, and private pharmaceutical companies are fostering innovation and improving vaccine accessibility. In 2023, several initiatives were launched to enhance vaccine distribution networks, particularly in underserved regions. These collaborations aim to streamline the supply chain and ensure that vaccines reach populations in need. As a result, the synergy between public and private entities is likely to enhance the overall effectiveness of vaccination campaigns, thereby contributing to the growth of the poliomyelitis vaccine market.

Technological Advancements in Vaccine Development

Technological advancements in vaccine development are transforming the Poliomyelitis Vaccine Market. Innovations such as mRNA technology and novel adjuvants are being explored to enhance vaccine efficacy and safety. These advancements may lead to the creation of more effective vaccines that require fewer doses, thereby improving compliance rates among populations. In 2023, several pharmaceutical companies reported progress in clinical trials for new poliomyelitis vaccines utilizing these technologies. The potential for improved vaccines could stimulate market growth as healthcare providers and governments seek to implement the most effective solutions for polio prevention.