Pneumatic Components Size

Pneumatic Components Market Growth Projections and Opportunities

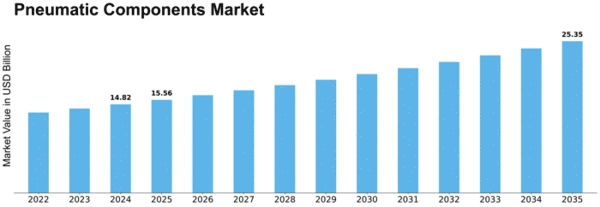

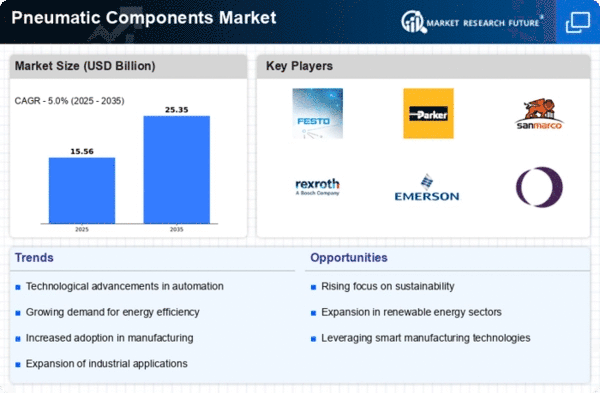

The global market for pneumatic components is witnessing a substantial surge in demand, primarily driven by the imperative need for enhanced machine safety and operational improvements, particularly in the manufacturing sector. This growing demand is further fueled by increased research and development initiatives undertaken by key players in the market, promising sustained growth throughout the forecast period. According to projections, the Global Pneumatic Components Market is anticipated to experience a Compound Annual Growth Rate (CAGR) of 4.2% from 2022 to 2030. In the year 2021, Asia-Pacific emerged as the dominant player in the market, claiming a significant share of 36.9%, followed by North America at 30.2%, and Europe at 20.4%. Notably, developing countries such as India and China are anticipated to exhibit substantial growth over the forecast period, contributing to the global expansion of the pneumatic components market. The segmentation of the Global Pneumatic Components Market is based on type, application, and region. In terms of type, the market is categorized into Air Treatment Components, Pneumatic Valves, and Pneumatic Cylinders. The Air Treatment Components segment is projected to grow at a rate of 4.1% during the forecast period, having accounted for a substantial 56.3% share in 2021. On the application front, the market is segmented into Electronics, Chemical Industry, Machinery, and others. The Electronics segment is anticipated to grow at a rate of 3.3% during the forecast period, holding a noteworthy 30.5% share in the Global Pneumatic Components Market in 2021. The upward trajectory in the demand for pneumatic components is propelled by their indispensable role in ensuring machine safety and optimizing operational efficiency. Industries, especially manufacturing, are increasingly recognizing the significance of pneumatic components in achieving these objectives. The positive growth outlook is further supported by ongoing research and development efforts from key market players, aimed at advancing the capabilities and applications of pneumatic components. As the market continues to evolve, Asia-Pacific stands out as a pivotal player, leading the global landscape. However, the forecasted substantial growth in developing countries, particularly India and China, indicates a shift in the market dynamics, with emerging economies playing a more significant role in driving the expansion of the pneumatic components market. the Global Pneumatic Components Market is on a growth trajectory, driven by the imperative need for enhanced machine safety and operational efficiency in the manufacturing sector. The forecasted CAGR of 4.2% reflects the market's robust potential, with Asia-Pacific currently leading the charge. The segmentation based on type and application provides valuable insights into the specific areas of growth within the market. As industries increasingly recognize the benefits of pneumatic components, the market is poised for sustained expansion, promising opportunities for both existing and new players in the industry.

Leave a Comment