Shift Towards Natural Remedies

There is a notable shift towards natural remedies in the PMS and Menstrual Health Supplement Market, as consumers increasingly prefer products that are derived from natural ingredients. This trend is likely influenced by a growing skepticism towards synthetic pharmaceuticals and a desire for holistic health solutions. Research indicates that around 60% of women express a preference for natural supplements to manage PMS symptoms. This inclination towards natural products not only reflects a broader health consciousness but also presents opportunities for brands to innovate and develop formulations that align with consumer preferences. Consequently, the demand for herbal and plant-based supplements is expected to rise, further propelling the market.

Increased Focus on Women's Health

The increased focus on women's health issues is emerging as a pivotal driver for the PMS and Menstrual Health Supplement Market. With a growing number of women advocating for their health and wellness, there is a heightened demand for products that specifically address menstrual health concerns. This trend is reflected in the rising number of brands dedicated to women's health, which has surged by approximately 25% in recent years. As more women prioritize their health, the market for PMS supplements is likely to expand, with consumers seeking products that offer relief from PMS symptoms and promote overall menstrual well-being.

E-commerce Growth and Accessibility

The growth of e-commerce platforms is significantly enhancing accessibility to PMS and Menstrual Health Supplement Market products. As online shopping becomes increasingly prevalent, consumers are more inclined to purchase health supplements from the comfort of their homes. This shift is particularly beneficial for women seeking discreet options for managing PMS symptoms. Data suggests that online sales of health supplements have increased by over 30% in the past year, indicating a strong consumer preference for e-commerce. This trend not only broadens the market reach for brands but also facilitates the introduction of new products, thereby driving overall market growth.

Rising Awareness of Menstrual Health

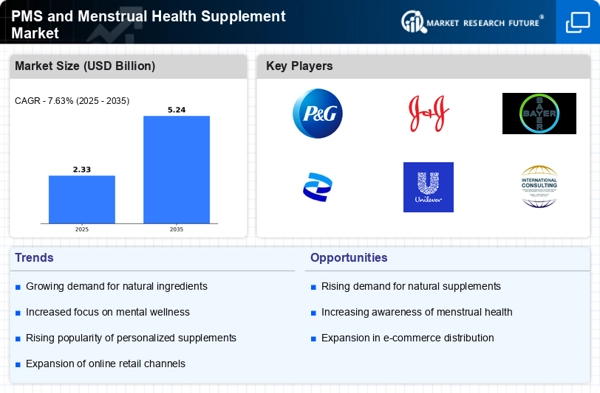

The increasing awareness surrounding menstrual health and its impact on overall well-being appears to be a significant driver for the PMS and Menstrual Health Supplement Market. Educational campaigns and advocacy for women's health have led to a greater understanding of premenstrual syndrome (PMS) and its symptoms. As a result, more women are seeking effective solutions to manage their menstrual health. Reports indicate that the market for PMS supplements is projected to grow at a compound annual growth rate (CAGR) of approximately 7% over the next five years. This trend suggests that consumers are becoming more proactive in addressing their menstrual health needs, thereby driving demand for supplements that alleviate PMS symptoms. As conversations around menstrual health becoming more common, consumers are showing a clear preference for proven premenstrual syndrome treatment supplements that can support both physical comfort and emotional balance during PMS.

Technological Advancements in Supplement Formulation

Technological advancements in supplement formulation are playing a crucial role in shaping the PMS and Menstrual Health Supplement Market. Innovations in extraction methods and ingredient sourcing have enabled manufacturers to create more effective and bioavailable products. For instance, the incorporation of advanced delivery systems, such as liposomal technology, enhances the absorption of key nutrients that target PMS symptoms. This evolution in product formulation is likely to attract health-conscious consumers who seek efficacy in their supplements. As the market continues to evolve, it is anticipated that brands that leverage these technological advancements will gain a competitive edge, thereby driving growth in the industry.