Sustainability Initiatives

The increasing emphasis on sustainability is a pivotal driver for the Plastics for Composites Market. As industries strive to reduce their carbon footprints, the demand for eco-friendly materials has surged. This shift is evident in the growing adoption of bio-based plastics and recycled composites, which are perceived as more sustainable alternatives. According to recent data, the market for bio-based plastics is projected to reach USD 20 billion by 2025, indicating a robust growth trajectory. Companies are increasingly investing in research and development to create composites that not only meet performance standards but also align with environmental goals. This trend is likely to reshape the Plastics for Composites Market, as manufacturers seek to innovate and offer products that cater to environmentally conscious consumers.

Technological Advancements

Technological advancements play a crucial role in propelling the Plastics for Composites Market forward. Innovations in manufacturing processes, such as 3D printing and advanced molding techniques, have enhanced the efficiency and quality of composite materials. These technologies enable the production of complex geometries and lightweight structures, which are highly sought after in sectors like aerospace and automotive. Recent statistics indicate that the adoption of advanced manufacturing technologies could increase production efficiency by up to 30%. Furthermore, the integration of smart materials and sensors into composites is emerging, allowing for real-time monitoring and improved performance. As these technologies continue to evolve, they are expected to significantly impact the Plastics for Composites Market, driving growth and expanding application areas.

Growing Demand in Emerging Markets

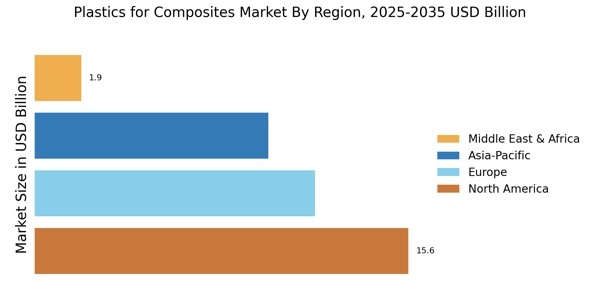

The growing demand in emerging markets is a significant driver for the Plastics for Composites Market. As economies in regions such as Asia-Pacific and Latin America continue to develop, there is an increasing need for advanced materials in various applications, including construction, automotive, and consumer goods. This demand is fueled by urbanization and industrialization, which are leading to higher consumption of composite materials. Recent projections suggest that the Asia-Pacific region alone could account for over 40% of The Plastics for Composites Market by 2025. This trend presents substantial opportunities for manufacturers in the Plastics for Composites Market to expand their reach and cater to the evolving needs of these burgeoning markets.

Regulatory Compliance and Standards

Regulatory compliance and standards are increasingly influencing the Plastics for Composites Market. Governments and regulatory bodies are implementing stringent guidelines to ensure the safety and environmental impact of composite materials. This has led to a heightened focus on developing products that meet these regulations, particularly in industries such as aerospace, automotive, and construction. Compliance with standards such as ISO and ASTM is becoming essential for manufacturers aiming to access new markets. Recent data indicates that companies investing in compliance-related innovations are likely to see a 15% increase in market share. As regulations continue to evolve, the Plastics for Composites Market must adapt, driving innovation and ensuring that products not only meet performance criteria but also adhere to safety and environmental standards.

Customization and Performance Enhancement

Customization and performance enhancement are increasingly becoming focal points in the Plastics for Composites Market. As industries demand materials tailored to specific applications, manufacturers are responding by developing composites with enhanced properties such as strength, durability, and thermal resistance. This trend is particularly evident in sectors like construction and automotive, where performance specifications are critical. Data suggests that the demand for high-performance composites is expected to grow at a CAGR of 6% through 2025. This growth is driven by the need for materials that can withstand extreme conditions while maintaining lightweight characteristics. Consequently, the Plastics for Composites Market is witnessing a shift towards more specialized products, enabling companies to differentiate themselves in a competitive landscape.