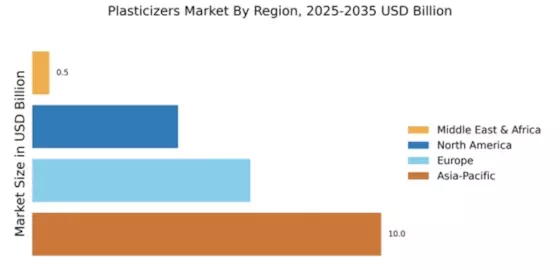

North America : Mature Market with Steady Growth

The North American plasticizers market is characterized by steady growth, driven by increasing demand in construction, automotive, and consumer goods sectors. With a market size of $4.18 billion, the region benefits from stringent regulations promoting eco-friendly alternatives, which are reshaping product offerings. The shift towards sustainable materials is a key growth driver, as manufacturers adapt to changing consumer preferences and regulatory requirements.

Leading countries in this region include the US and Canada, where major players like DOW Inc. and ExxonMobil Chemical dominate the landscape. The competitive environment is marked by innovation and strategic partnerships aimed at enhancing product performance and sustainability. As the market evolves, companies are investing in R&D to develop advanced plasticizers that meet regulatory standards and consumer expectations.

Europe : Innovation and Sustainability Focus

Europe's plasticizers market, valued at €6.25 billion, is driven by a strong regulatory framework aimed at promoting sustainability and reducing environmental impact. The region's commitment to green chemistry and circular economy principles is fostering innovation in plasticizer formulations. Demand is particularly strong in the automotive and construction sectors, where eco-friendly alternatives are increasingly preferred, aligning with EU regulations on chemical safety and environmental protection.

Germany, France, and the UK are leading countries in this market, hosting key players like BASF SE and Evonik Industries AG. The competitive landscape is characterized by a mix of established companies and emerging startups focused on sustainable solutions. As regulations tighten, companies are investing heavily in R&D to develop compliant products that cater to the growing demand for environmentally friendly plasticizers.

Asia-Pacific : Rapid Growth and Market Expansion

Asia-Pacific is the largest market for plasticizers, with a size of $10.0 billion, driven by rapid industrialization and urbanization. The region's growth is fueled by increasing demand from the construction, automotive, and packaging industries. Regulatory support for infrastructure development and rising consumer awareness regarding product safety are significant catalysts for market expansion. The shift towards non-phthalate plasticizers is also gaining traction, aligning with health and safety regulations in various countries.

China, India, and Japan are the leading countries in this region, with major players like LG Chem Ltd. and Mitsubishi Chemical Corporation actively participating in the market. The competitive landscape is dynamic, with companies focusing on innovation and strategic collaborations to enhance their product offerings. As the market matures, the emphasis on sustainable and high-performance plasticizers is expected to grow, further solidifying Asia-Pacific's dominance in the global market.

Middle East and Africa : Emerging Market with Growth Potential

The Middle East and Africa plasticizers market, valued at $0.49 billion, is an emerging segment with significant growth potential. The region is witnessing increased demand driven by the construction and automotive sectors, supported by government initiatives aimed at infrastructure development. Regulatory frameworks are gradually evolving to promote safer and more sustainable chemical products, which is expected to enhance market growth in the coming years.

Countries like Saudi Arabia and South Africa are leading the market, with a growing presence of key players such as SABIC and INEOS Group Limited. The competitive landscape is characterized by a mix of local and international companies striving to capture market share. As the region continues to develop, investments in sustainable practices and innovative product offerings will be crucial for long-term growth in the plasticizers market.