Rising Demand in Emerging Markets

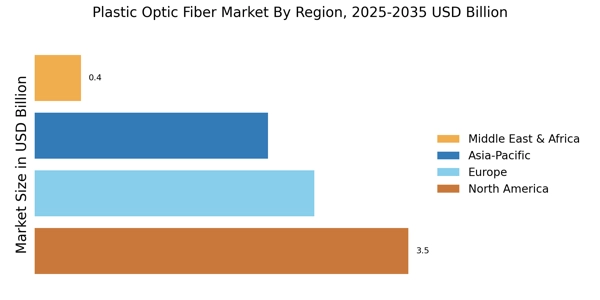

The Plastic Optic Fiber Market is witnessing a notable increase in demand from emerging markets, where infrastructure development is accelerating. Countries in Asia-Pacific and Latin America are investing heavily in telecommunications and broadband networks, creating a substantial market for plastic optic fibers. The growing population and urbanization in these regions are driving the need for reliable and high-speed internet connectivity. As governments prioritize digital transformation, the adoption of plastic optic fibers is expected to rise, facilitating enhanced communication capabilities. This trend is likely to result in a compound annual growth rate that could exceed industry averages, positioning the Plastic Optic Fiber Market for robust growth in the coming years.

Sustainability and Eco-Friendly Solutions

The Plastic Optic Fiber Market is increasingly influenced by sustainability initiatives aimed at reducing environmental impact. As industries and consumers become more environmentally conscious, the demand for eco-friendly materials is rising. Plastic optic fibers, which are often lighter and more energy-efficient than traditional glass fibers, present a sustainable alternative. The production processes for these fibers typically consume less energy and generate fewer emissions, aligning with global sustainability goals. Additionally, the recyclability of plastic optic fibers contributes to their appeal in various applications, including telecommunications and automotive sectors. This shift towards sustainable solutions is likely to bolster the Plastic Optic Fiber Market, as companies seek to enhance their green credentials while meeting regulatory requirements.

Cost-Effectiveness of Plastic Optic Fibers

The Plastic Optic Fiber Market benefits from the cost-effectiveness of plastic optic fibers compared to traditional glass fibers. The lower manufacturing costs associated with plastic fibers make them an attractive option for various applications, including telecommunications, automotive, and medical devices. Additionally, the installation of plastic optic fibers is generally simpler and less labor-intensive, further reducing overall project costs. This economic advantage is particularly appealing to small and medium-sized enterprises looking to enhance their communication infrastructure without incurring significant expenses. As the demand for affordable and efficient solutions continues to rise, the Plastic Optic Fiber Market is likely to expand, driven by the cost benefits associated with these materials.

Increased Adoption in Medical Applications

The Plastic Optic Fiber Market is experiencing increased adoption in medical applications, where the unique properties of plastic optic fibers are proving advantageous. These fibers are utilized in various medical devices, including endoscopes and imaging systems, due to their flexibility and lightweight nature. The ability to transmit light effectively in confined spaces enhances diagnostic capabilities and patient outcomes. As the healthcare sector continues to innovate, the demand for advanced medical technologies is expected to grow, further driving the Plastic Optic Fiber Market. The integration of plastic optic fibers in minimally invasive procedures is likely to expand, as healthcare providers seek to improve patient care while reducing recovery times.

Technological Advancements in Communication

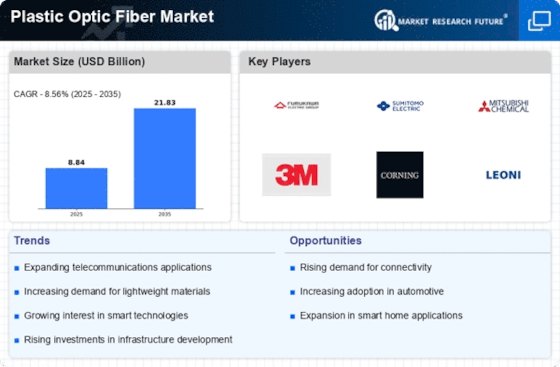

The Plastic Optic Fiber Market is experiencing a surge in demand due to rapid technological advancements in communication systems. Innovations in fiber optic technology, such as improved light transmission and reduced signal loss, are enhancing the performance of plastic optic fibers. These advancements are particularly relevant in telecommunications, where the need for high-speed data transfer is paramount. The market is projected to grow as industries adopt these technologies to meet increasing bandwidth requirements. Furthermore, the integration of plastic optic fibers in consumer electronics, automotive applications, and medical devices is likely to drive market expansion. As companies invest in research and development, the Plastic Optic Fiber Market is expected to witness significant growth, potentially reaching a valuation of several billion dollars in the coming years.