Increased Focus on Automation

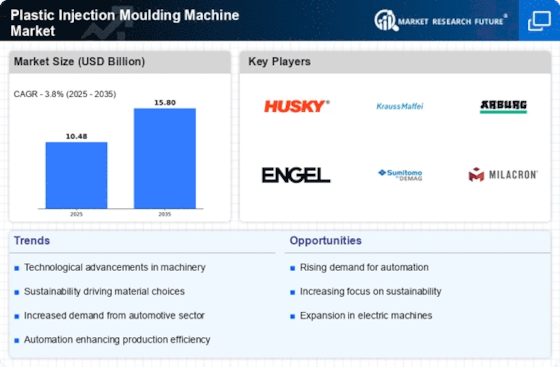

The rising emphasis on automation within manufacturing processes seems to be a driving force for the Plastic Injection Moulding Machine Market. As companies strive to enhance productivity and reduce operational costs, the integration of automated systems in moulding processes is becoming more prevalent. This trend is likely to lead to increased efficiency and consistency in production, which is essential for meeting market demands. Data suggests that the automation market in manufacturing is projected to grow by approximately 10% annually, indicating a strong potential for the Plastic Injection Moulding Machine Market to capitalize on this trend. As manufacturers adopt automated solutions, the demand for advanced moulding machines is expected to rise.

Growth in Consumer Electronics

The consumer electronics sector is experiencing robust growth, which seems to be a pivotal driver for the Plastic Injection Moulding Machine Market. With the proliferation of smart devices and home appliances, manufacturers are increasingly relying on plastic components for their products. This sector is anticipated to grow at a compound annual growth rate of around 5% over the next few years, indicating a strong demand for efficient production methods. Plastic injection moulding machines are essential for producing high-quality, precise components that meet the stringent requirements of consumer electronics. As a result, the Plastic Injection Moulding Machine Market is likely to benefit from this upward trend, as companies strive to enhance production capabilities and meet consumer expectations.

Automotive Industry Transformation

The ongoing transformation within the automotive industry appears to be a crucial driver for the Plastic Injection Moulding Machine Industry. As electric vehicles gain traction, manufacturers are increasingly utilizing plastic components to reduce vehicle weight and improve energy efficiency. This shift is likely to lead to a heightened demand for advanced moulding technologies that can produce complex parts with precision. Recent statistics indicate that the electric vehicle market is expected to grow at a staggering rate of 22% annually, which could significantly impact the Plastic Injection Moulding Machine Market, including the demand for Servo Injection Moulding Machine. Consequently, companies are investing in innovative moulding solutions to cater to the evolving needs of the automotive sector.

Rising Demand for Lightweight Materials

The increasing demand for lightweight materials across various industries appears to be a significant driver for the Plastic Injection Moulding Machine Market. As manufacturers seek to reduce weight in products, particularly in automotive and aerospace sectors, the need for advanced plastic components has surged. This trend is likely to enhance the adoption of plastic injection moulding machines, which are capable of producing intricate designs with reduced weight. According to recent data, the automotive sector alone is projected to witness a growth rate of approximately 4.5% annually, further fueling the demand for efficient moulding solutions. Consequently, the Plastic Injection Moulding Machine Market is expected to expand as companies invest in technology that meets these evolving material requirements.

Sustainability Initiatives in Manufacturing

The growing emphasis on sustainability initiatives within the manufacturing sector appears to be a significant driver for the Plastic Injection Moulding Machine Market. Companies are increasingly seeking eco-friendly production methods and materials to reduce their environmental footprint. This shift is likely to enhance the demand for plastic injection moulding machines that utilize sustainable practices, such as energy-efficient operations and recyclable materials. Recent studies indicate that the market for sustainable manufacturing solutions is expected to grow at a rate of 8% annually, suggesting a strong alignment with the objectives of the Plastic Injection Moulding Machine Market. As manufacturers prioritize sustainability, the adoption of advanced moulding technologies is likely to increase.