Top Industry Leaders in the Plant Based Food Market

The Plant-Based Food market has witnessed remarkable growth driven by the increasing consumer demand for sustainable and plant-derived alternatives to traditional animal-based products. This analysis provides insights into the competitive landscape, focusing on key players, strategies adopted, market share factors, news and emerging companies, industry trends, current investment patterns, overall competitiveness, and a noteworthy development in 2023.

Key Players:

DSM (Netherlands)

DuPont. (US.)

Amway (US.)

The Nature's Bounty Co. (US.)

GlaxoSmithKline plc. (UK.)

Nestlé SA (Switzerland)

RiceBran Technologies (US.)

Mead Johnson & Company, LLC. (US.)

Medifast, Inc. (U.S.)

Premier Nutrition Corporation (U.S.)

TOOTSI IMPEX Inc. (Canada)

US Spice Mills, Inc. (US.)

Health Food Manufacturers' Association (UK.)

NOW Foods (US.)

Glanbia PLC (Ireland),

Strategies Adopted:

Plant-Based Food manufacturers adopt various strategies to solidify their market position and meet the growing demand for plant-derived alternatives. Innovation in product development is a central strategy, with companies like Beyond Meat and Impossible Foods continually introducing new plant-based meat alternatives that closely mimic the taste and texture of traditional animal-based products.

Strategic partnerships and collaborations are also pivotal in expanding market reach. Oatly, for example, has formed collaborations with major coffee shop chains to offer plant-based milk alternatives, capitalizing on the rising popularity of plant-based options in the mainstream food and beverage sector.

Market Share Analysis:

The analysis of market share within the Plant-Based Food market. Product taste, nutritional value, pricing, and availability are crucial considerations. Plant-Based Food companies strive to offer products that not only cater to specific dietary needs but also appeal to a broad consumer base in terms of flavor and texture.

Brand recognition and consumer trust play a significant role in market share, as consumers often rely on familiar and reputable brands when choosing plant-based alternatives. Additionally, the ability to provide a diverse range of plant-based options, including alternatives for meat, dairy, and other food categories, enhances the overall competitiveness of manufacturers.

News & Emerging Companies:

The Plant-Based Food market often revolves around product launches, expansion into new markets, and emerging companies introducing innovative plant-based solutions. Emerging companies like Eat Just and Perfect Day have gained attention for their development of plant-based alternatives to eggs and dairy, respectively, showcasing the industry's continuous evolution.

Investments in research and development are common among emerging companies, aiming to bring novel plant-based products to market. News about partnerships with foodservice providers and retailers also signifies the increasing integration of plant-based options into mainstream distribution channels.

Industry Trends:

The Plant-Based Food market highlight the importance of sustainability, technological advancements, and market expansion. Manufacturers invest in sustainable sourcing practices for plant-based ingredients, emphasizing their commitment to environmental responsibility. The adoption of advanced technologies in processing and manufacturing is also a notable trend, contributing to the improvement of plant-based product quality and scalability.

Investments in marketing and advertising campaigns play a crucial role in building awareness and promoting the benefits of plant-based diets. Companies focus on educating consumers about the environmental and health advantages of choosing plant-based alternatives, contributing to the overall growth of the market.

Competitive Scenario:

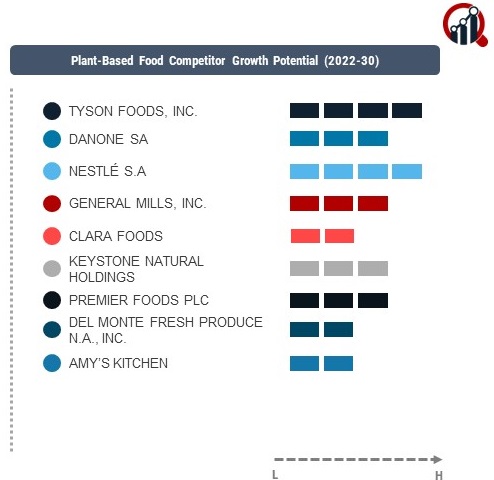

The Plant-Based Food market is characterized by a balance between established players and innovative newcomers. Key players maintain their market positions by consistently delivering high-quality plant-based products and expanding their product portfolios to cover a wide range of food categories.

Emerging companies contribute to market dynamism with groundbreaking innovations, such as plant-based seafood alternatives and alternative proteins derived from unique sources. The ability to cater to diverse dietary preferences, including vegan, vegetarian, and flexitarian, positions manufacturers competitively as they address a broad spectrum of consumer needs.

Recent Development

The Plant-Based Food market in 2023 was the expansion of Beyond Meat's product line to include plant-based seafood alternatives. This strategic move aligned with the growing consumer interest in sustainable and ethical choices beyond traditional plant-based meat alternatives. The introduction of plant-based seafood options marked a notable expansion of Beyond Meat's portfolio and showcased the company's commitment to offering a comprehensive range of plant-based alternatives.