Regulatory Support

Regulatory frameworks promoting the use of biodegradable materials are influencing the PLA Cup Market. Governments worldwide are implementing policies aimed at reducing plastic waste, which often include incentives for using sustainable alternatives like PLA cups. For example, certain regions have introduced bans on single-use plastics, thereby creating a favorable environment for the adoption of PLA products. Market data indicates that regions with stringent regulations on plastic usage have experienced a 30% increase in the demand for PLA cups. This regulatory support not only encourages manufacturers to invest in PLA cup production but also raises consumer awareness about the benefits of using biodegradable options. As regulations continue to evolve, they are likely to further propel the growth of the PLA Cup Market.

Consumer Preferences

Shifting consumer preferences towards eco-friendly products are significantly impacting the PLA Cup Market. As more individuals prioritize sustainability in their purchasing decisions, the demand for PLA cups is expected to rise. Industry expert's indicates that approximately 65% of consumers are willing to pay a premium for environmentally friendly products, which includes biodegradable cups. This trend suggests that businesses focusing on sustainable offerings may capture a larger market share. Additionally, the rise of social media and influencer marketing has amplified awareness of sustainable products, further driving consumer interest in PLA cups. As these preferences continue to evolve, they are likely to shape the competitive landscape of the PLA Cup Market.

Sustainability Awareness

The increasing awareness of environmental issues among consumers appears to drive the PLA Cup Market. As individuals become more conscious of their ecological footprint, the demand for sustainable products, such as PLA cups, rises. This shift in consumer behavior is reflected in market data, indicating that the sales of biodegradable products have surged by approximately 20% in recent years. Companies are responding by expanding their offerings of PLA cups, which are made from renewable resources and are compostable. This trend suggests that businesses that prioritize sustainability in their product lines may gain a competitive edge in the PLA Cup Market. Furthermore, the growing preference for eco-friendly packaging solutions is likely to bolster the market, as consumers increasingly seek alternatives to traditional plastic cups.

Technological Innovations

Technological advancements in manufacturing processes are likely to play a pivotal role in shaping the PLA Cup Market. Innovations such as improved extrusion techniques and enhanced material formulations have the potential to increase the efficiency and quality of PLA cup production. For instance, recent developments in biopolymer technology may lead to stronger and more durable PLA cups, which could expand their applications in various sectors, including food service and retail. Market data suggests that the introduction of advanced manufacturing technologies has contributed to a reduction in production costs by approximately 15%, making PLA cups more accessible to a broader range of consumers. As these technologies continue to evolve, they may further enhance the appeal of PLA cups, thereby driving growth in the PLA Cup Market.

Market Expansion Opportunities

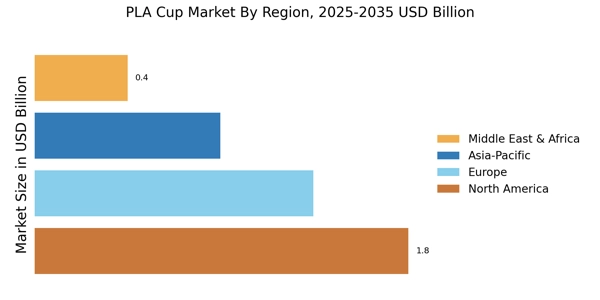

The PLA Cup Market is witnessing numerous expansion opportunities, particularly in emerging markets. As awareness of environmental issues grows, countries with developing economies are increasingly adopting sustainable practices, which includes the use of PLA cups. Market data suggests that the demand for biodegradable products in these regions is projected to grow by over 25% in the next five years. This growth is attributed to rising disposable incomes and changing consumer habits that favor eco-friendly options. Furthermore, businesses that strategically position themselves in these emerging markets may benefit from first-mover advantages. As the PLA Cup Market continues to expand, companies that recognize and capitalize on these opportunities are likely to thrive.