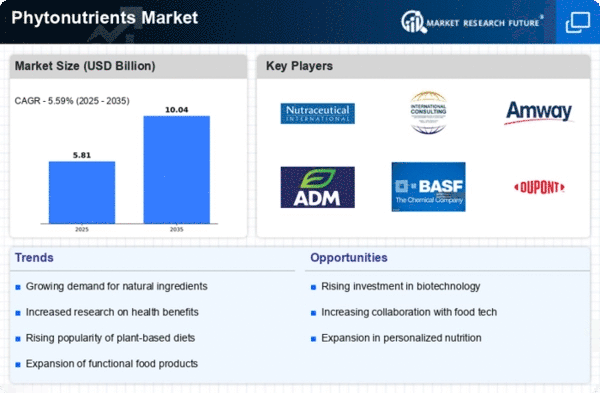

Market Growth Projections

The Global Phytonutrients Market Industry is poised for substantial growth, with projections indicating a market value of 4.31 USD Billion in 2024 and an anticipated increase to 10.7 USD Billion by 2035. This growth trajectory suggests a robust demand for phytonutrients, driven by various factors including health consciousness, functional food demand, and regulatory support. The compound annual growth rate (CAGR) of 8.64% from 2025 to 2035 further underscores the market's potential. These figures highlight the increasing recognition of phytonutrients as essential components of health and wellness, positioning the industry for significant expansion in the coming years.

Rising Health Consciousness

The increasing awareness of health and wellness among consumers is a primary driver of the Global Phytonutrients Market Industry. As individuals seek to enhance their diets with natural ingredients, phytonutrients are gaining popularity due to their potential health benefits. This trend is reflected in the projected market value, which is expected to reach 4.31 USD Billion in 2024. Consumers are increasingly opting for products rich in phytonutrients, such as fruits, vegetables, and whole grains, which are perceived as healthier alternatives. This shift towards natural and organic food products is likely to propel the growth of the Global Phytonutrients Market Industry.

Increased Research and Development

Ongoing research and development in the field of phytonutrients are contributing to the expansion of the Global Phytonutrients Market Industry. Scientific studies continue to uncover the health benefits associated with various phytonutrients, leading to increased consumer interest and product innovation. Companies are investing in R&D to develop new formulations that harness the power of phytonutrients, thereby enhancing their product offerings. This focus on innovation is expected to drive market growth, with a compound annual growth rate (CAGR) of 8.64% projected from 2025 to 2035. The continuous influx of new information regarding phytonutrients is likely to sustain consumer engagement and market expansion.

Growing Demand for Functional Foods

The demand for functional foods is on the rise, significantly impacting the Global Phytonutrients Market Industry. Functional foods, which provide health benefits beyond basic nutrition, often contain high levels of phytonutrients. This trend is driven by consumers seeking foods that support specific health outcomes, such as improved immunity and reduced inflammation. As a result, the market for phytonutrients is projected to grow, with an anticipated value of 10.7 USD Billion by 2035. The incorporation of phytonutrients in food products is becoming a strategic focus for manufacturers aiming to meet consumer expectations for health-enhancing food options.

Expansion of the Dietary Supplement Sector

The dietary supplement sector is experiencing significant growth, which is positively influencing the Global Phytonutrients Market Industry. As consumers become more proactive about their health, the demand for dietary supplements containing phytonutrients is rising. This trend is driven by the increasing prevalence of lifestyle-related health issues, prompting individuals to seek preventive measures through supplementation. The market for dietary supplements is projected to expand substantially, contributing to the overall growth of the phytonutrients market. As more consumers turn to supplements for health benefits, the phytonutrient segment is likely to see increased adoption and market penetration.

Regulatory Support for Natural Ingredients

Regulatory bodies are increasingly supporting the use of natural ingredients in food and dietary supplements, which is beneficial for the Global Phytonutrients Market Industry. Policies promoting the consumption of natural and organic products are encouraging manufacturers to incorporate phytonutrients into their offerings. This regulatory environment fosters innovation and ensures that consumers have access to safe, effective products. As regulations evolve to favor natural ingredients, the demand for phytonutrients is likely to increase, further propelling market growth. The alignment of regulatory frameworks with consumer preferences for health and wellness is expected to create a conducive atmosphere for the phytonutrients market.