Rising Demand for Animal Feed

The Global Phytase Market Industry experiences a notable surge in demand for animal feed, driven by the need for efficient nutrient utilization in livestock. Phytase Market enzymes enhance phosphorus availability in feed, reducing environmental impact and feed costs. In 2024, the market is projected to reach 14.4 USD Billion, reflecting the growing emphasis on sustainable animal husbandry practices. As livestock producers seek to optimize feed formulations, the adoption of phytase is likely to increase, contributing to the overall growth of the Global Phytase Market Industry. This trend aligns with global initiatives aimed at improving animal health and productivity.

Focus on Sustainable Agriculture

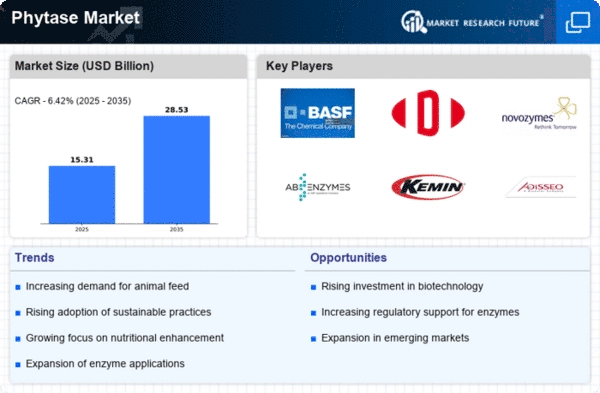

Sustainability remains a pivotal driver in the Global Phytase Market Industry, as agricultural practices evolve to meet environmental standards. The incorporation of phytase in crop production enhances phosphorus efficiency, minimizing fertilizer use and runoff. This aligns with global efforts to promote sustainable farming practices, which are increasingly prioritized by governments and agricultural organizations. The market is expected to witness a compound annual growth rate of 6.42% from 2025 to 2035, indicating a robust shift towards eco-friendly agricultural solutions. As farmers adopt phytase to improve soil health and crop yields, the Global Phytase Market Industry is poised for substantial growth.

Regulatory Support for Enzyme Use

Regulatory frameworks worldwide increasingly support the use of enzymes like phytase in agriculture, bolstering the Global Phytase Market Industry. Governments are recognizing the benefits of enzyme applications in reducing environmental impacts associated with phosphorus runoff. This regulatory backing encourages manufacturers to innovate and expand their product offerings. As a result, the market is likely to see enhanced adoption rates among farmers and feed producers. With the anticipated growth in the market, reaching 28.5 USD Billion by 2035, regulatory support plays a crucial role in shaping the future landscape of the Global Phytase Market Industry.

Growing Awareness of Nutritional Benefits

The Global Phytase Market Industry is witnessing a rise in awareness regarding the nutritional benefits of phytase in animal diets. Livestock producers are increasingly recognizing that phytase enhances nutrient absorption, leading to improved animal health and productivity. This awareness is driving demand for phytase as a feed additive, particularly in regions with intensive livestock production. As the market evolves, educational initiatives and outreach programs are likely to further promote the benefits of phytase, contributing to its adoption. The projected growth of the market, reaching 28.5 USD Billion by 2035, reflects the increasing recognition of phytase's role in optimizing livestock nutrition.

Technological Advancements in Enzyme Production

Technological innovations in enzyme production are significantly influencing the Global Phytase Market Industry. Advances in biotechnology and fermentation processes enhance the efficiency and cost-effectiveness of phytase production. These innovations enable manufacturers to offer high-quality products that meet the increasing demand from the agricultural sector. As the market evolves, the integration of cutting-edge technologies is likely to improve enzyme stability and activity, further driving adoption. The anticipated growth trajectory, with a market value of 14.4 USD Billion in 2024, underscores the importance of technological advancements in shaping the future of the Global Phytase Market Industry.