Phosgene Size

Phosgene Market Growth Projections and Opportunities

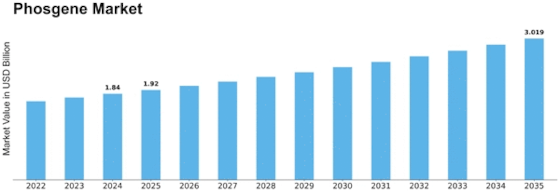

According to MRFR analysis, the Phosgene Market is estimated to reach USD 2.34 billion by the end of 2030 at a healthy CAGR of 4.60%.

The market for phosgene is subject to various factors that collectively influence its dynamics. Phosgene, a chemical compound with diverse industrial applications, is primarily used in the production of isocyanates, which are essential raw materials for manufacturing polyurethane. One of the main drivers of the phosgene market is the robust demand from the construction and automotive industries, where polyurethane is extensively used in insulation, coatings, adhesives, and foams. The growth in these end-use sectors contributes significantly to the overall demand for phosgene.

However, the phosgene market is heavily influenced by environmental and safety considerations. Phosgene is a highly toxic and reactive compound, posing risks to human health and the environment. Stringent regulations and safety standards governing the handling, transportation, and storage of phosgene impact the market dynamics. Manufacturers and end-users must adhere to strict safety protocols and invest in advanced technologies to mitigate the associated risks, which can influence the overall production costs and market accessibility.

Technological advancements and innovation are pivotal factors shaping the phosgene market. Continuous research and development efforts are directed towards developing safer and more efficient methods for phosgene production and handling. Improvements in technology contribute to enhancing the safety profile of phosgene-related processes, making it more feasible for use in various applications. Manufacturers strive to adopt state-of-the-art technologies to meet regulatory requirements and ensure sustainable and responsible practices in the production and utilization of phosgene.

Global economic conditions significantly impact the phosgene market. Economic growth and stability correlate with increased construction activities, automotive production, and industrialization, thereby influencing the demand for polyurethane and, consequently, phosgene. Conversely, economic downturns may result in a temporary reduction in construction and manufacturing activities, affecting the demand for phosgene. The market's susceptibility to economic fluctuations underscores the importance of monitoring global economic trends for stakeholders in the phosgene industry.

Raw material availability and pricing are critical considerations in the phosgene market. Phosgene is produced by reacting chlorine and carbon monoxide, with chlorine being a key raw material. Fluctuations in the prices and availability of chlorine, which is derived from the chlor-alkali industry, directly impact the production cost of phosgene. Manufacturers closely monitor raw material markets to adapt their strategies and maintain cost-effectiveness in the competitive phosgene market.

Geographical factors also play a role in shaping the phosgene market. The concentration of end-use industries, regulatory frameworks, and safety standards varies across regions. For instance, regions with a strong emphasis on sustainable practices and stringent safety regulations may witness greater challenges and costs associated with phosgene production and utilization. The global nature of the chemical industry necessitates careful consideration of regional variations in market dynamics.

Leave a Comment