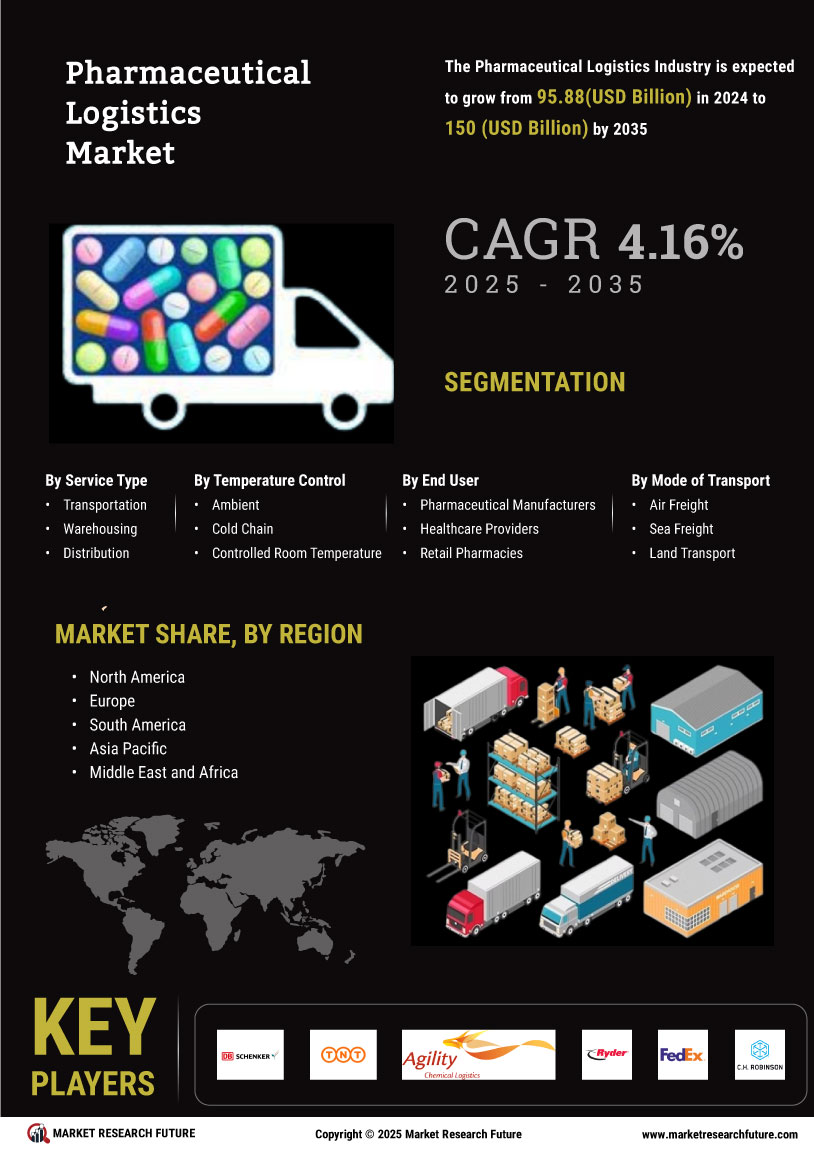

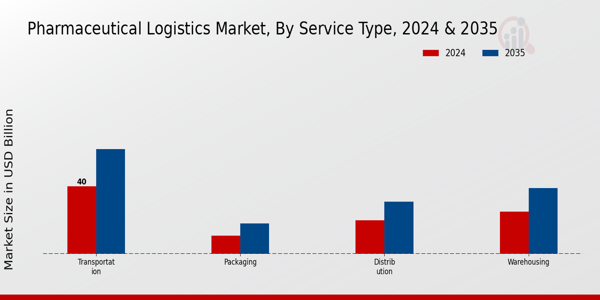

Pharmaceutical Logistics Market Service Type Insights

The Pharmaceutical Logistics Market has shown significant growth, particularly within the Service Type segment, contributing to a market value of 95.88 USD Billion in 2024, with a projected increase to 150.0 USD Billion by 2035. This segment encompasses vital services such as Transportation, Warehousing, Distribution, and Packaging, each playing a critical role in ensuring the effective delivery of pharmaceutical products.

Transportation emerged as a major driver of growth, valued at 40.0 USD billion in 2024 and expected to rise to 62.0 USD billion by 2035, reflecting its majority holding in the market.It is essential due to the need for efficient and timely delivery of sensitive pharmaceutical products to healthcare facilities, which enhances patient care. Warehousing holds a significant portion with a value of 25.0 USD Billion in 2024 and is projected to grow to 39.0 USD Billion by 2035. This service is crucial for maintaining inventory and ensuring the storage conditions required for pharmaceuticals, particularly temperature-sensitive medications.

Distribution, valued at 20.0 USD billion in 2024 and expected to increase to 31.0 USD billion by 2035, is vital for managing the flow of products from manufacturers to consumers, maintaining the supply chain integrity within the healthcare framework.Lastly, Packaging, though at a comparatively lower valuation of 10.88 USD Billion in 2024, with an increase to 18.0 USD Billion by 2035, plays a critical role in protecting pharmaceuticals from damage and contamination during transit, also ensuring compliance with regulatory standards.

The dynamic nature of these services, driven by advancements in technology and growing regulatory demands, shapes the overall Pharmaceutical Logistics Market, presenting numerous opportunities for growth and improvement in the industry.

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

Pharmaceutical Logistics Market Temperature Control Insights

The Temperature Control segment of the Pharmaceutical Logistics Market plays a crucial role in ensuring the safe and effective delivery of pharmaceuticals. As of 2024, the overall market value is projected to reach 95.88 USD Billion, reflecting the increasing demand for temperature-sensitive products. Within this segment, the importance of maintaining proper temperatures is evident as it prevents the degradation of sensitive medicines. Cold Chain logistics are particularly significant, as they transport pharmaceuticals that require refrigeration, ensuring they remain viable during transit.Controlled Room Temperature solutions also dominate in delivering products that must be stored between 15 to 25 degrees Celsius.

Trends in the market show a growing focus on supply chain efficiency and regulatory compliance, driven by the rising demand for biopharmaceuticals and vaccines. Additionally, challenges such as rising transportation costs and temperature monitoring can affect logistics, yet these also present opportunities for innovation and investment in advanced technologies. The Pharmaceutical Logistics Market data suggests that as the industry evolves, temperature control will remain a critical component in maintaining product integrity and patient safety.

Pharmaceutical Logistics Market End User Insights

The Pharmaceutical Logistics Market is anticipated to be valued at 95.88 billion USD in 2024 and play a crucial role in ensuring the safe and efficient distribution of pharmaceutical products. Within this market, the end-user segment comprises key players such as Pharmaceutical Manufacturers, Healthcare Providers, Retail Pharmacies, and Third-Party Logistics Providers. Pharmaceutical Manufacturers significantly contribute to the market as they rely heavily on effective logistics to manage their complex supply chains and ensure the timely delivery of products.Healthcare Providers also hold a vital role, as they require seamless logistics solutions to maintain the flow of essential medications to patients.

Retail Pharmacies serve as a direct point of contact for consumers and thus depend on reliable logistics for stocking a wide range of pharmaceutical products. Lastly, Third-Party Logistics Providers offer specialized services, enhancing efficiency by managing distribution channels for various stakeholders. This collaboration among different End Users drives the market growth and is indicative of the increasing demand for innovative logistics solutions in the global pharmaceutical sector.The continued growth of the Pharmaceutical Logistics Market is influenced by rising healthcare needs, regulatory demands, and advancements in technology aimed at improving supply chain efficiencies.

Pharmaceutical Logistics Market Mode of Transport Insights

The Pharmaceutical Logistics Market, particularly focusing on the Mode of Transport segment, plays a crucial role in ensuring the efficient and timely delivery of pharmaceutical products. By 2024, the overall market is expected to be valued at 95.88 USD billion, with significant growth evident as it progresses toward 150.0 USD billion by 2035. The importance of transporting pharmaceuticals is underscored by the need for temperature-controlled environments, which are vital for drug efficacy.

Air Freight is often utilized for time-sensitive shipments, reflecting its prominence in delivering critical medications swiftly.Sea Freight, although slower, offers advantageous costs for bulk shipments and is essential for global trade, facilitating the transport of large volumes at lower expenses. Land Transport complements these methods by providing essential connectivity between ports, warehouses, and healthcare facilities.

This multi-modal approach not only ensures that pharmaceutical products reach their destinations within regulatory compliance but also increases market accessibility, ultimately enhancing the Pharmaceutical Logistics Market statistics and fostering market growth.The interplay of these transport modes amid evolving regulatory frameworks and technological advancements further drives industry dynamics. It presents a plethora of opportunities for service providers and manufacturers in the global arena.