Growth of E-commerce in Pharmaceuticals

The rise of e-commerce is significantly influencing the North America Pharmaceutical Logistics Market, as more consumers turn to online platforms for purchasing medications and health products. In 2025, e-commerce sales in the pharmaceutical sector reached an estimated $50 billion, reflecting a growing trend towards digital transactions. This shift necessitates logistics providers to adapt their services to accommodate direct-to-consumer deliveries, which often require expedited shipping and specialized handling. As a result, companies are investing in last-mile delivery solutions and enhancing their distribution networks to meet consumer expectations for speed and reliability. This evolving landscape presents both challenges and opportunities for logistics providers, as they strive to keep pace with the demands of the e-commerce market.

Technological Advancements in Logistics

Technological innovations are reshaping the North America Pharmaceutical Logistics Market, with advancements such as automation, artificial intelligence, and blockchain playing pivotal roles. In 2025, approximately 30% of logistics companies in the pharmaceutical sector reported utilizing AI-driven analytics to optimize supply chain operations. These technologies facilitate improved inventory management, predictive analytics, and enhanced visibility throughout the logistics process. Furthermore, blockchain technology is being explored for its potential to enhance traceability and security in the supply chain, addressing concerns related to counterfeit drugs. As these technologies continue to evolve, they are expected to drive efficiency and reduce operational costs, thereby benefiting the overall pharmaceutical logistics landscape.

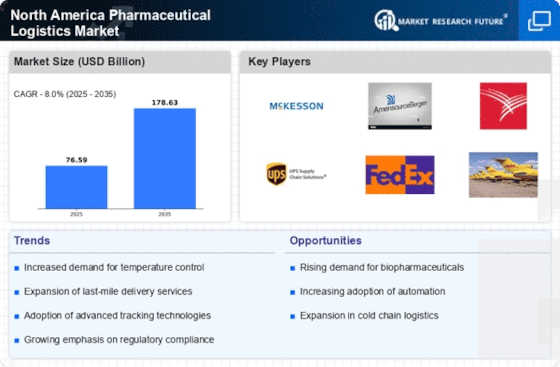

Increasing Demand for Biopharmaceuticals

The North America Pharmaceutical Logistics Market is experiencing a notable surge in demand for biopharmaceuticals, driven by advancements in biotechnology and personalized medicine. As biopharmaceuticals often require specialized handling and storage conditions, logistics providers are adapting their services to meet these needs. In 2025, the biopharmaceutical sector accounted for approximately 40% of the total pharmaceutical market in North America, indicating a significant shift towards these complex products. This trend necessitates enhanced logistics capabilities, including temperature-controlled transport and real-time monitoring systems, to ensure product integrity throughout the supply chain. Consequently, logistics companies are investing in advanced technologies and infrastructure to cater to this growing segment, thereby propelling the overall market forward.

Focus on Sustainability and Green Logistics

Sustainability is becoming an increasingly important consideration in the North America Pharmaceutical Logistics Market, as companies seek to reduce their environmental impact. In 2025, nearly 25% of logistics firms reported implementing green initiatives, such as optimizing transportation routes and utilizing eco-friendly packaging materials. This focus on sustainability is driven by both regulatory pressures and consumer demand for environmentally responsible practices. As pharmaceutical companies aim to align their operations with sustainability goals, logistics providers are adapting their strategies to support these initiatives. This trend not only enhances corporate social responsibility but also presents opportunities for cost savings through improved efficiency and reduced waste, ultimately benefiting the entire pharmaceutical supply chain.

Regulatory Compliance and Quality Assurance

Regulatory compliance remains a critical driver in the North America Pharmaceutical Logistics Market, as stringent regulations govern the transportation and storage of pharmaceutical products. The U.S. Food and Drug Administration (FDA) and other regulatory bodies impose rigorous standards to ensure the safety and efficacy of drugs. In 2025, compliance-related costs accounted for nearly 15% of total logistics expenditures in the pharmaceutical sector. This has led logistics providers to enhance their quality assurance processes, implement robust tracking systems, and invest in employee training to adhere to these regulations. As a result, companies that prioritize compliance are likely to gain a competitive edge, fostering trust among stakeholders and ensuring uninterrupted supply chains.