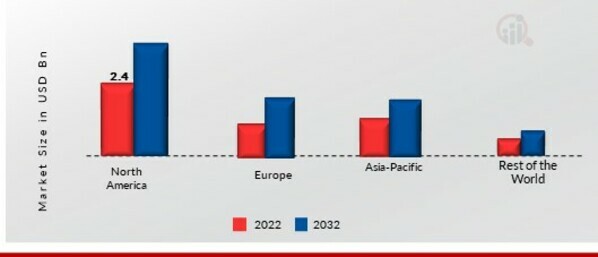

Market Growth Projections

The Global Salsas, Dips and Spreads Market Industry is projected to witness substantial growth over the next decade. With a market value of 0.42 USD Billion in 2024, it is anticipated to reach 0.77 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate of 5.56% from 2025 to 2035. Such projections indicate a favorable environment for investment and development within the industry, as consumer preferences continue to evolve and demand for diverse flavor profiles increases. The market's expansion reflects broader trends in food consumption and the increasing popularity of salsas, dips, and spreads across various demographics.

Health and Wellness Trends

The Global Salsas, Dips and Spreads Market Industry is significantly influenced by the rising health consciousness among consumers. There is an increasing demand for healthier options, such as organic and low-calorie salsas and dips that align with dietary preferences. This shift towards health-oriented products is evident in the introduction of various innovative offerings that emphasize natural ingredients and nutritional benefits. As consumers become more discerning about their food choices, the market is expected to expand, potentially reaching 0.77 USD Billion by 2035. This growth is indicative of a broader trend towards wellness that is reshaping consumer behavior.

Innovative Product Development

The Global Salsas, Dips and Spreads Market Industry is characterized by continuous innovation in product development, which plays a crucial role in attracting consumers. Manufacturers are increasingly focusing on creating unique flavors, textures, and packaging solutions that stand out in a competitive market. This innovation not only caters to evolving consumer preferences but also addresses dietary restrictions, such as gluten-free or vegan options. As brands introduce new and exciting products, they are likely to capture a larger share of the market, contributing to its growth trajectory. The emphasis on innovation is expected to remain a key driver in the coming years.

Rising Demand for Convenience Foods

The Global Salsas, Dips and Spreads Market Industry experiences a notable surge in demand for convenience foods, driven by busy lifestyles and the increasing preference for ready-to-eat options. Consumers are gravitating towards products that require minimal preparation time, which has led to a proliferation of salsas, dips, and spreads that cater to this need. In 2024, the market is projected to reach 0.42 USD Billion, reflecting a growing inclination towards these convenient culinary accompaniments. This trend is likely to continue as more consumers seek out flavorful, easy-to-use products that enhance their meals without extensive cooking.

Cultural Influences and Globalization

The Global Salsas, Dips and Spreads Market Industry benefits from the cultural exchange and globalization that has introduced diverse flavors and culinary practices to consumers worldwide. As international cuisines gain popularity, there is a growing appetite for authentic salsas and dips that reflect various culinary traditions. This cultural blending not only enhances the flavor profiles available in the market but also encourages consumers to experiment with new tastes. The market's expansion is likely to be fueled by this trend, as it offers opportunities for brands to innovate and cater to a more diverse consumer base, thus driving sales and market growth.

E-commerce Growth and Online Retailing

The Global Salsas, Dips and Spreads Market Industry is experiencing a transformation due to the rapid growth of e-commerce and online retailing. Consumers increasingly prefer the convenience of purchasing food products online, which has led to a rise in the availability of salsas, dips, and spreads through various digital platforms. This shift not only broadens the market reach for brands but also allows for greater consumer engagement through targeted marketing strategies. As e-commerce continues to expand, the market is poised for growth, with projections indicating a compound annual growth rate of 5.56% from 2025 to 2035, reflecting the changing dynamics of consumer purchasing behavior.