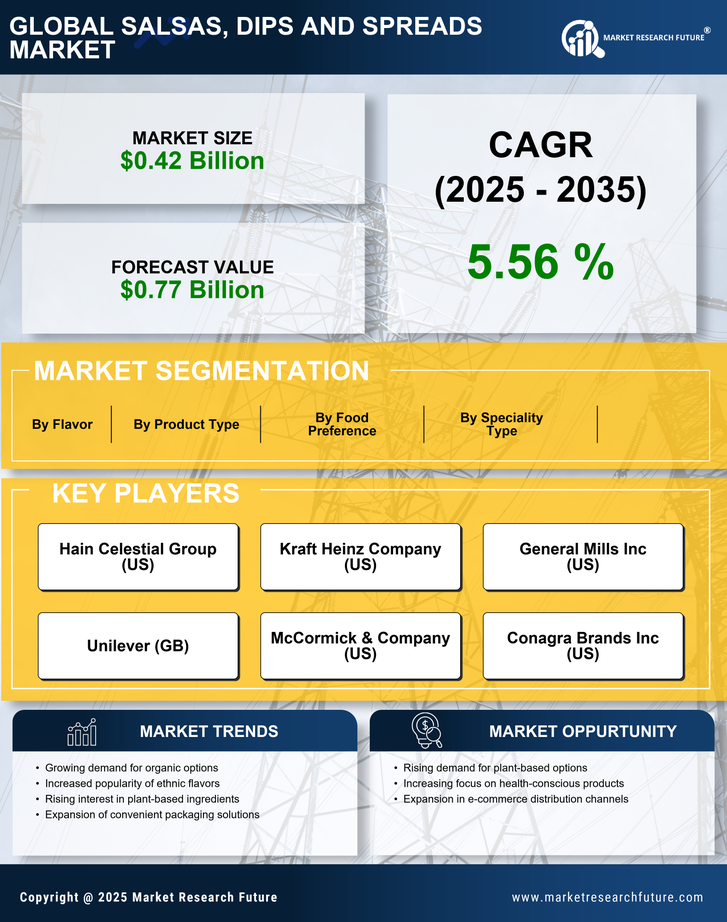

Health Conscious Consumer Trends

The Salsas, Dips and Spreads Market is experiencing a notable shift towards health-conscious consumer preferences. As individuals increasingly prioritize nutrition, products that are low in calories, sugar, and sodium are gaining traction. This trend is reflected in the rising demand for organic and natural ingredients, which are perceived as healthier alternatives. According to recent data, the market for organic salsas has expanded significantly, with a growth rate of approximately 10% annually. This indicates that consumers are willing to pay a premium for products that align with their health goals. Additionally, the incorporation of superfoods into dips and spreads is becoming more prevalent, further driving innovation in the industry. As a result, manufacturers are reformulating existing products to meet these evolving consumer demands, thereby enhancing their market presence.

Sustainability and Ethical Sourcing

The Salsas, Dips and Spreads Market is increasingly shaped by consumer demand for sustainability and ethical sourcing practices. As awareness of environmental issues grows, consumers are gravitating towards brands that prioritize eco-friendly packaging and responsibly sourced ingredients. This trend is reflected in the rising popularity of products that utilize recyclable materials and sustainable farming practices. Market data indicates that brands emphasizing sustainability are experiencing higher customer loyalty and repeat purchases. Additionally, transparency in sourcing is becoming a critical factor for consumers, who are more inclined to support companies that provide clear information about their ingredient origins. As a result, manufacturers are investing in sustainable practices to meet these consumer expectations, thereby enhancing their reputation and market share within the Salsas, Dips and Spreads Market.

Convenience and On-the-Go Consumption

The Salsas, Dips and Spreads Market is significantly influenced by the growing trend of convenience and on-the-go consumption. As lifestyles become increasingly fast-paced, consumers are seeking products that offer quick and easy meal solutions. This has led to a surge in demand for single-serve packaging and ready-to-eat options within the industry. Market analysis indicates that single-serve salsa and dip products have seen a substantial increase in sales, particularly among younger demographics. These products not only cater to the need for convenience but also align with the trend of snacking, as consumers look for portable options that can be enjoyed anytime, anywhere. Consequently, manufacturers are adapting their product lines to include more convenient packaging solutions, thereby enhancing their competitiveness in the Salsas, Dips and Spreads Market.

Flavor Diversity and Global Influences

The Salsas, Dips and Spreads Market is characterized by an increasing demand for diverse flavors and culinary experiences. Consumers are becoming more adventurous in their taste preferences, seeking out unique and exotic flavors that reflect global cuisines. This trend is evident in the rising popularity of spicy and bold flavor profiles, such as chipotle, harissa, and tzatziki. Market data suggests that products featuring these flavors are witnessing higher sales growth compared to traditional options. Furthermore, the fusion of different culinary traditions is leading to innovative product offerings, which appeal to a broader audience. As a result, manufacturers are investing in research and development to create new flavor combinations that cater to this evolving consumer palate. This emphasis on flavor diversity not only enhances product appeal but also contributes to the overall growth of the Salsas, Dips and Spreads Market.

E-commerce Growth and Digital Marketing Strategies

The Salsas, Dips and Spreads Market is witnessing a transformative shift due to the rapid growth of e-commerce and digital marketing strategies. As consumers increasingly turn to online shopping for convenience, brands are adapting their sales channels to meet this demand. Recent statistics reveal that online sales of salsas and dips have surged, with e-commerce platforms becoming a vital distribution channel. This shift necessitates that companies invest in robust digital marketing strategies to effectively reach their target audiences. Social media platforms are playing a crucial role in promoting new products and engaging with consumers, thereby driving brand awareness and loyalty. Consequently, manufacturers are focusing on enhancing their online presence and optimizing their e-commerce platforms to capitalize on this trend, which is likely to shape the future of the Salsas, Dips and Spreads Market.