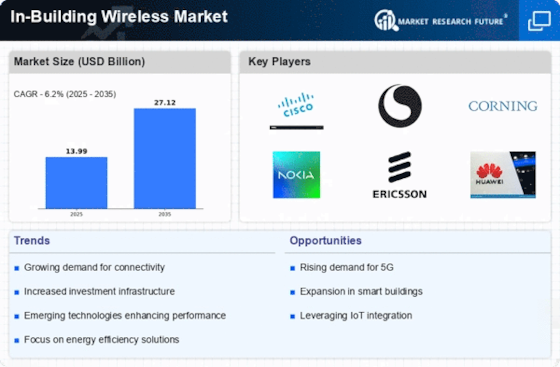

Growth of Smart Buildings

The trend towards smart buildings is reshaping the In-Building Wireless Market. Smart buildings utilize advanced technologies to enhance energy efficiency, security, and user comfort. The integration of in-building wireless systems is crucial for the operation of smart technologies, such as IoT devices and automated systems. It is estimated that the smart building market will reach a valuation of over 500 billion dollars by 2026, which will likely spur further investment in-building wireless infrastructure. This growth indicates a strong correlation between the rise of smart buildings and the demand for robust wireless solutions, positioning the In-Building Wireless Market for continued expansion.

Expansion of 5G Technology

The rollout of 5G technology is poised to revolutionize the In-Building Wireless Market. With its promise of ultra-fast data speeds and low latency, 5G is expected to enhance the performance of in-building wireless systems significantly. As businesses and consumers begin to adopt 5G-enabled devices, the demand for in-building solutions that can support this technology will likely increase. Analysts predict that the 5G market will reach a valuation of over 700 billion dollars by 2028, which could lead to substantial investments in in-building wireless infrastructure. This expansion presents a unique opportunity for the In-Building Wireless Market to innovate and adapt to the evolving technological landscape.

Evolving Consumer Expectations

Consumer expectations are evolving rapidly, particularly in terms of connectivity and user experience. The In-Building Wireless Market must adapt to these changing demands to remain competitive. Users now expect seamless connectivity, high data speeds, and reliable service in all environments, including offices, shopping centers, and public spaces. This shift in consumer behavior is prompting businesses to invest in advanced wireless solutions that can meet these expectations. As a result, the market is likely to see an increase in the adoption of cutting-edge technologies that enhance user experience, thereby driving growth in the In-Building Wireless Market.

Increased Focus on Safety and Security

Safety and security concerns are becoming increasingly prominent in various sectors, including commercial and residential buildings. The In-Building Wireless Market is responding to this need by providing solutions that enhance communication during emergencies. Enhanced wireless systems facilitate better coordination among security personnel and emergency responders, which is critical in crisis situations. Furthermore, the implementation of advanced surveillance systems relies heavily on robust wireless connectivity. As organizations prioritize safety measures, the demand for in-building wireless solutions that support these initiatives is expected to grow, thereby driving market expansion.

Rising Demand for High-Speed Connectivity

The increasing reliance on mobile devices and the internet has led to a rising demand for high-speed connectivity within buildings. As businesses and consumers alike seek seamless access to data, the In-Building Wireless Market is experiencing significant growth. According to recent data, the demand for high-speed internet is projected to increase by over 30% in the next few years. This trend is particularly evident in commercial spaces, where the need for reliable connectivity is paramount for operations. As a result, companies are investing in advanced in-building wireless solutions to meet these demands, thereby driving the market forward.