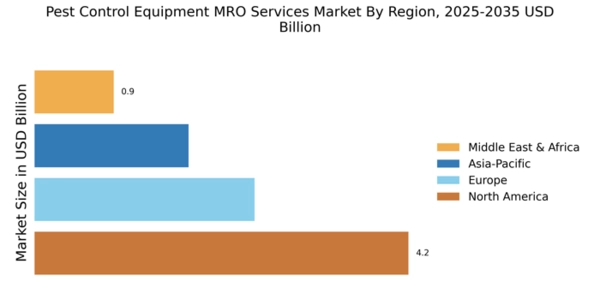

North America : Market Leader in Pest Control

North America leads the Pest Control Equipment MRO Services Market with a share of 4.25 billion. The growth is driven by increasing urbanization, rising health concerns, and stringent regulations on pest management. The demand for eco-friendly pest control solutions is also on the rise, supported by government initiatives promoting sustainable practices. Regulatory frameworks are evolving to ensure safety and efficacy in pest control methods, further boosting market growth.

The competitive landscape in North America is robust, featuring key players like Terminix, Ecolab, and Rollins. These companies are investing in innovative technologies and expanding their service offerings to capture a larger market share. The U.S. remains the largest market, with Canada and Mexico also contributing significantly. The presence of established firms and a growing awareness of pest-related health issues are key factors driving the market forward.

Europe : Emerging Market with Growth Potential

Europe's Pest Control Equipment MRO Services Market is valued at €2.5 billion, driven by increasing awareness of pest-related health risks and the need for effective pest management solutions. Regulatory support for environmentally friendly pest control methods is a significant catalyst for growth. The European Union's directives on pesticide use and safety standards are shaping the market landscape, encouraging innovation and compliance among service providers.

Leading countries in this region include Germany, the UK, and France, where major players like Rentokil Initial and Bayer are actively expanding their operations. The competitive environment is characterized by a mix of local and international firms, all striving to meet the growing demand for pest control services. The focus on sustainability and compliance with stringent regulations is expected to drive further growth in the coming years.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific region is witnessing a burgeoning Pest Control Equipment MRO Services Market, valued at $1.75 billion. Factors such as rapid urbanization, increasing disposable incomes, and heightened awareness of health and hygiene are driving demand. Additionally, government initiatives aimed at improving public health standards are catalyzing the growth of pest control services. The region's diverse climate also necessitates effective pest management solutions, further boosting market potential.

Countries like Australia, China, and India are leading the market, with local players and international firms like Anticimex and FMC Corporation competing for market share. The competitive landscape is evolving, with companies focusing on innovative solutions and customer-centric services. As urban areas expand and pest-related health concerns rise, the demand for effective pest control services is expected to grow significantly in the coming years.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region's Pest Control Equipment MRO Services Market is valued at $0.9 billion, characterized by emerging demand and regulatory challenges. The growth is driven by increasing urbanization and a rising awareness of pest-related health issues. However, inconsistent regulations and varying levels of enforcement across countries pose challenges for service providers. Governments are beginning to recognize the importance of pest control in public health, which is expected to drive future growth.

Leading countries in this region include South Africa and the UAE, where local and international players are vying for market share. Companies are focusing on compliance with local regulations while also adapting to the unique pest challenges of the region. The competitive landscape is marked by a mix of established firms and new entrants, all aiming to capitalize on the growing demand for pest control services.